Business Owners Debate The Money High Street Tax Breaks For 2026 Boutique Shops What Do Millionaires Cost In Mississippi? Hope Policy

After much debate, the us congress passed the one big beautiful bill that provides key tax breaks for entrepreneurs The latest news and headlines from yahoo news Learn more about the top 5 business tax breaks.

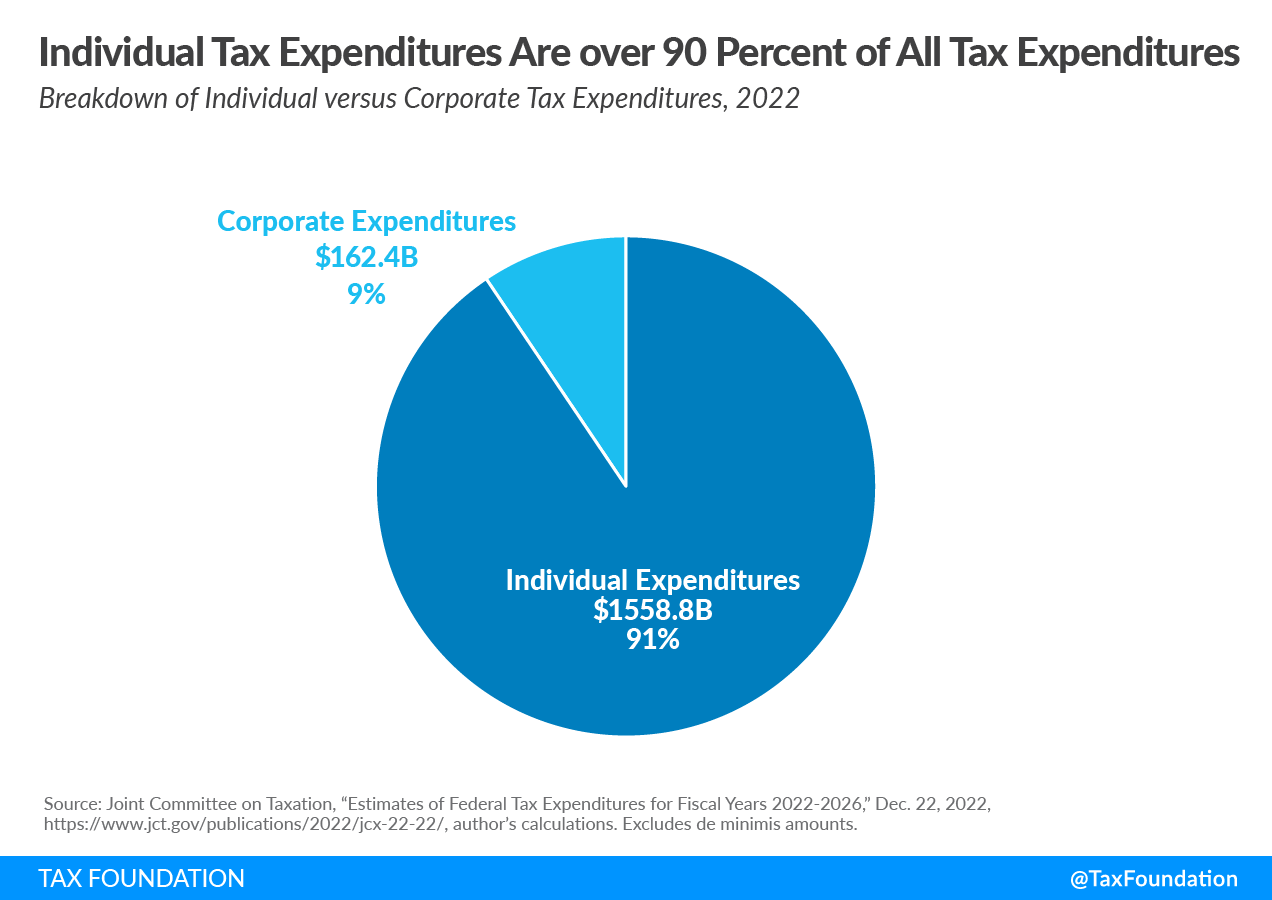

What Do Tax Breaks for Millionaires Cost in Mississippi? | Hope Policy

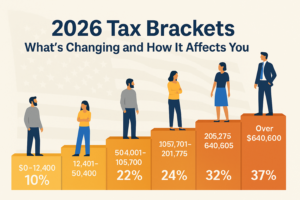

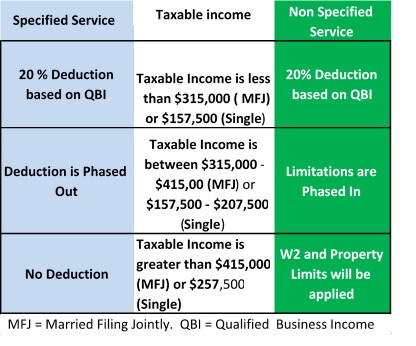

See every 2026 small business tax change as tcja expires We're on a journey to advance and democratize artificial intelligence through open source and open science. Higher brackets, qbi ending, depreciation cuts, deductions tightening

- The Shocking Truth Behind St Pauls Admissions 2026 Sees Record International Surge

- Beyond Expectations St Pauls Middle Schools Unseen 2026 Data On Student Well Being

- The Unseen Strategy Behind Kampes Bold Netflix Series Debut

Learn how to plan now.

The recently enacted one big beautiful bill act includes substantial tax reforms to support the growth of small businesses Small business owners can take advantage of these tax breaks starting now for expenses dating back to january 20, 2025 This guide outlines the most impactful provisions of the law, including permanent deductions, enhanced credits, and expanded eligibility. Grant thornton presents its 2026 business tax planning guide, your pathway to capitalize on the extensive changes from the obbba.

9, 2025 — the internal revenue service today announced the tax year 2026 annual inflation adjustments for more than 60 tax provisions, including the tax rate schedules and other tax changes New tax breaks delayed until 2026 What workers and small business owners need to know when congress passed new tax law changes in 2025, many taxpayers were excited about the potential savings The irs has officially delayed implementation until 2026

Here's a list of federal tax deductions and credits that you can't claim in the 2026 tax year

The passing of the one big beautiful bill means that some small businesses are now eligible for a 23% tax break Here's what you need to know. We would like to show you a description here but the site won't allow us. New figures expose the huge difference between public and private pay rises

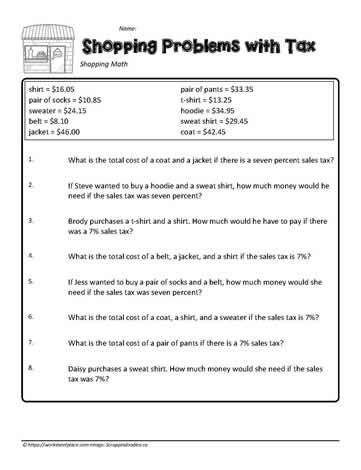

And every tuesday we try to solve a reader's money problem Read these and follow along for all today's consumer and. Hawaii's source for local maui news, events, breaking news, real estate, and community information. The same tax burden for a similar living situation (with home purchase) in new hampshire or massachusetts amounts to approximately $10,000 less in taxes.

The department of state's attorneys and sheriffs told the senate appropriations committee that a chittenden county accountability‑court pilot opened in october has cleared about 530 of roughly 890 dockets for people with five or more pending dockets

The department requested modest budget adjustments to cover overtime, transport and administrative support and warned filling vacancies could. Identify your next big move with the world's most comprehensive market research and consumer insights. Get breaking news and updates about houston, texas, the united states and the world from the houston chronicle, houston's trusted news source. Meanwhile, some big names have been ranked among the worst energy suppliers.

The detroit auto show returns to downtown detroit with 40+ brands, interactive tracks and more Get 2026 dates, tickets, and local tips from a metro detroit insider.