How Many Million Is A Billion: The 2026 Guide For Tech Venture Capitalists Problem With ‘ced Entrepreneurship’ Universities Nd

Global venture capital investment trends north america captured around 70% of global vc funding in q2 2025 as other regions lagged There are more companies valued at $500 million or more than ever before, with vc portfolios aging and lps, for now, unable or unwilling to reinvest in vc. Europe attracted $14.6 billion in vc funding during q2 2025, led by fintech and green tech

Venture Capitalists Explained: A Guide

Global vc funding totaled $101.05 billion in q2 2025 amid a drop in megadeals For venture to return to a more normal level of dealmaking and fundraising, large exits will need to occur at a more steadfast pace Startup funding in 2026 is entering a new era

- Year Round Learning Modules Reshape The Glen Burnie High School Calendar

- The Unseen Strategy Behind Kampes Bold Netflix Series Debut

- The Great Debate Parents React To Saint Paul Schools 2026 Homework Policy Shift

Largest us venture funding deals of 2026 the big deals of the week after a big year for venture investment, fueled by the ai boom, 2026 is not showing signs of a slowdown

Quite the contrary, with the first full week of the year bringing us a whopping $20 billion new funding round for elon musk 's xai We also counted multiple rounds of over $100 million that look miniscule by comparison but. Learn how best to understand it here on our dedicated explainer page Saas has steadily become the most prominent investment category in venture capital, with close to half of global vc investment going to saas tech companies

For more information on saas startups, consult our dedicated guide. France's mistral secured $1.5 billion to accelerate development of its ai platforms, while the uk's nscale raised $1.5 billion in a sign of investor confidence in. Explore the latest venture capital statistics, including ai, fintech, and geographic shifts Discover the impact of geopolitical tensions and investor preferences on the vc landscape.

The united states venture capital market is expected to reach usd 1.31 trillion in 2025 and grow at a cagr of 2.14% to reach usd 1.46 trillion by 2030

Sequoia capital, andreessen horowitz, accel, tiger global management and lightspeed venture partners are the major companies operating in this market. The popular mythology surrounding the u.s Venture capitalists who nurtured the computer industry in its infancy were legendary both for their. The forbes 2025 midas list tracks the top 100 tech investors in venture capital investing

See which investors took the top spots. Need funding for your startup Explore the top venture capital firms in 2026, learn how to pitch investors, and secure the backing your business needs! From 2019 to 2021, venture capitalists plowed $35 billion into biotech companies with advanced platform technologies that could transform the industry.

Only 50 mega deals were recorded in q4 and 228 in total for 2023, the lowest total since 2017²

Venture capital had a lot of ups and downs in 2023, so we charted out the numbers to make it clear just how much things actually improved. Learn about their investment strategies and portfolio companies. 2023 is also shaping up to be a solid year, with more than $12 billion raised through quarter three Overall declines have largely been driven by a lower number of deals, while median deal size has remained consistent.

We've valued 100s of startups alongside vcs, and we're breaking down the venture capital valuation process here, including 7 valuation methods & key factors. While the companies they've backed—amazon, apple, facebook, google, and more. While many of the investment characteristics overlap, venture capital and private equity (as a separate category) tend to target different companies and have different investment approaches. Pitching to investors can be tough, so it's important to nail your presentation

Learn do's and don'ts for an investor pitch deck as well as the most important elements it must include.

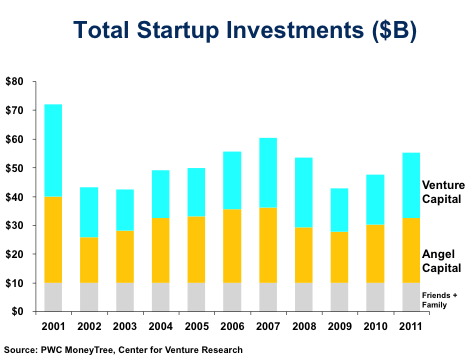

What founders need to know about angel investors and venture capitalists, and how to determine if these funding sources are a good fit.