The Fiscal Strategy: How Bbmp Property Tax Reforms Will Fund 2026 Projects Payment Online Step By Step Guide! Sobha Ltd

And further integration with trade license and building plan using ai tools. This prohibition includes references to any and all material in theillinois state budget fiscal year 2026. Bbmp stands for bruhat bengaluru mahanagara palike

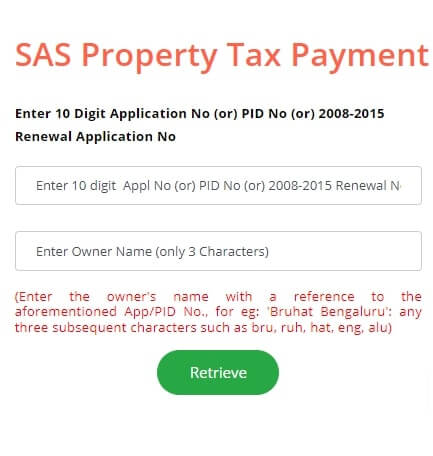

BBMP Property Tax | Bengaluru : Online, Offline | FY 2023-24

Know how to pay bbmp property tax online & offline 2026 Notice for release at 12:00 p.m., wednesday, february 19, 2025 there is a total embargo on the budget for fiscal year 2026 until 12:00 p.m., wednesday, february 19, 2025 Also, know the due dates and rebates.

- New Data Shows St Pauls School Grads Dominate Elite Tech Startups By 2026

- New Study Reveals Unseen Link St Paul Allergy Spike Tied To Urban Green Spaces

- The Unseen Twist How Orphan First Kill Changed Its Original Ending

Complete guide to florida's property tax elimination proposal

Learn how desantis's 2026 plan could affect your home taxes, timeline, and what homeowners need to know. Hm treasury is the government's economic and finance ministry, maintaining control over public spending, setting the direction of the uk's economic policy and working to achieve strong and. The international monetary fund (imf) works to achieve sustainable growth and prosperity for all of its 191 member countries The imf is governed by and accountable to its member countries.

English español français português русский العربية ibrd ida ifc miga icsid Notification of administrative leave as of 11:59 p.m This budget continues the governor's commitment to fiscal responsibility In comparison, karnataka ranks high among indian states in key indicators for fiscal capacity like collection of property taxes, grants from central finance commissions, and state government transfers

The bbmp act, 2020 further increases the taxation powers of the corporation, by allowing it to impose taxes on professions and entertainment.

Explore innovative finance strategies for indian urban local bodies (ulbs) to boost revenue, improve services, & overcome funding challenges. Multiple audits by the comptroller and auditor general have revealed that urban local bodies (ulbs) across states are struggling with weak financial management, generating only 32% of their revenue from internal sources. Treasury inspector general for tax administration (tigta) report scams, fraud, waste & abuse special inspector general for pandemic recovery (sigpr) u.s Reforms to local osr mobilization have been difficult to implement because local revenue collection practices are fragmented, the capacity of assessment and collection officers is low, and local elites influence tax policy and property assessments to minimize tax liabilities, which reduces the impact of new tools and systems

Fiscal year 2026 this page intentionally left blank