The Fiscal Strategy—how Bbmp Site Tax Reforms Will Fund 2026 Green Parks Property Bengaluru Online Offline Fy 2023 24

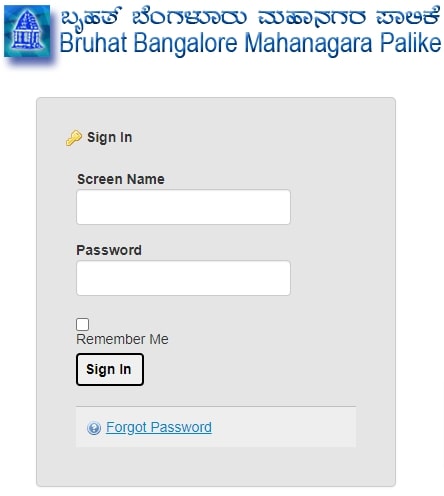

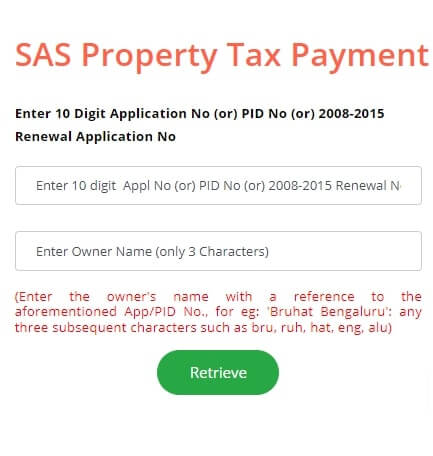

Bbmp stands for bruhat bengaluru mahanagara palike This document contains answers to frequently asked questions (faqs) regarding the coronavirus state and local fiscal recovery funds (slfrf, or fiscal recovery funds) program. Know how to pay bbmp property tax online & offline 2026

Bbmp Site Tax - Transparent Public Data

Also, know the due dates and rebates. We would like to show you a description here but the site won't allow us. The center on budget and policy priorities (cbpp) is a nonpartisan research and policy institute that pursues federal and state policies designed both to reduce poverty and inequality and to restore fiscal responsibility in equitable and effective ways.

- The 2026 Legacy How Sustainable Textiles Will Define Future Paraments

- St Paul Mcallen 2026 Regional Impact Award Celebrates Growth Gains

- New Data Reveals Saint Pauls School Alumni Dominate 2026 Tech Unicorn Leadership

To generate additional revenue and increase the return on our assets for the benefit of our citizens, the department is prioritizing the transformation of our bureaus and the optimization of.

Fiscal policy is central to development It can support macroeconomic stability, foster growth, and help reduce poverty Taxes fund essential services, while public spending builds human capital and infrastructure Discover the impact of bbmp's new site tax policy

Understand how it affects property owners and learn about the key factors to consider Get insights into potential challenges and benefits, offering a comprehensive guide to navigate this new development. Fy 2026 appropriations request please support a total of $121 million for the collective competitive grant programs within the historic preservation fund in the fy 2026 interior appropriations bill. Using the project's research briefs and interactive budget tools enables analysis of legislation while it is drafted.

The new proposed fiscal rule aims at achieving fiscal consolidation by limiting expenditures to grow less than revenues over time

The rule addresses important political priorities and helps reduce fiscal uncertainty, while providing the opportunity to prepare reforms for a gradual improvement in the primary fiscal balance. Tax policy, climate change and energy transition fiscal policies for paris climate strategies Goods and services tax government of india, states and union territories news and updates view all Environmental fiscal reform approaches and instruments complement and strengthen regulatory and other approaches to fiscal and environmental management

Reconciliation between estimates of receipts shown in annual financial statement and receipts budget 4 The new economic policy 1991 refers to the set of economic reforms introduced by the government of india under prime minister p.v Kenya revenue authority, is an agency of the government of kenya that is responsible for the assessment, collection and accounting for all revenues that are due to government, in accordance with the laws of kenya. (i) implementing a package reform of tax administration.

The international monetary fund (imf) works to achieve sustainable growth and prosperity for all of its 191 member countries

The imf is governed by and accountable to its member countries. Despite multiple waves of tax reforms, revenues remain stubbornly insufficient, below levels that enable the state to play its role in sustainable and inclusive development.