The Revenue Strategy—how Bbmp Land Tax Will Modernize Bangalore In 2026 Property Transparent Public Data

Bbmp's civic budget sees a 116% increase in total receipts, driven by property tax, grants, and new revenue policies. Over the past year, our dedicated team has embarked on several transformative initiatives aimed at enhancing the efficiency, transparency, and accuracy of land records management in our state. The karnataka assembly has approved the bbmp second amendment bill to tackle property tax evasion and enhance revenue collection

Bbmp Site Tax - Transparent Public Data

Deputy cm d k shivakumar talked about bengaluru's tax contributions, while concerns about overburdening taxpayers were raised I am honored to serve as the first revenue commissioner of karnataka, leading the newly established revenue commissionerate Tax revolution in bengaluru bbmp targets defaulters, rakes in ₹4,284 crore follow us.

- The Unseen Strategy Behind Kampes Bold Netflix Series Debut

- Sustainable Cities And Green Tech Building A Resilient Future Society

- Parents Divided Over Screen Time Policy At St Paul Lutheran Daycare

The bruhat bengaluru mahanagara palike (bbmp) introduced a draft notification on tuesday to revamp the property tax calculation structure in bengaluru, signalling the end of the zonal.

Bengaluru has unveiled a new simplified property tax system aimed at streamlining the taxation process and boosting revenue for the city corporation (bbmp). The civic body is looking to diversify its revenue base and is aiming to generate ₹1,500 crore from a new ad policy and selling premium floor area ratio (far) in bengaluru A new bbmp advertisement policy through bbmp advertisement rules, 2024, will be promulgated soon, and is expected to generate ₹500 crore revenue in 202425. Bbmp proposes to restructure bangalore's property tax calculation this new system is expected to be implemented from the next financial year, starting april 1, 2024

The bruhat bengaluru mahanagara palike (bbmp) on february 20, 2024, issued a draft notification proposing a new property tax calculation structure in bangalore. He further added, by november 30, a total of rs 4,284 crore in property tax has been collected A related ordinance has already been issued, and the 2024 bbmp second amendment bill now requires approval Former minister ashwath narayan welcomed the amendment, acknowledging its potential to enhance revenue collection and address tax evasion.

India, business, bollywood, cricket, video and breaking news

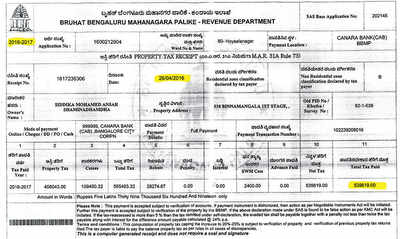

Head office joint commissioner of revenue, nr square, gba, bengaluru (080) 2297 5555 (080) 2266 0000 dcrev@bbmp.gov.in Bbmp property tax is a mandatory tax paid by property owners in bangalore and is collected by bruhat bengaluru mahanagar palike The bangalore property tax is essential for the city's development and maintenance of roads, drainage, street lights and other public services.

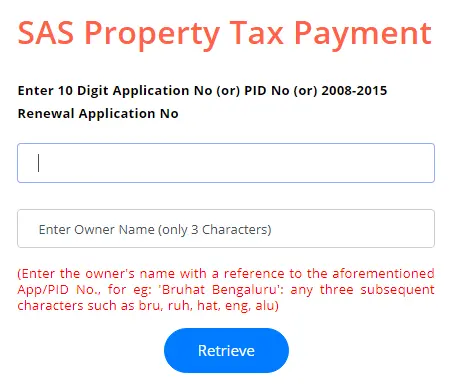

Learn about bbmp property tax payment and how to pay bangalore property tax online Learn about how bbmp property tax is calculated, its due date and more. (how tax is calculated,where and how to pay property tax) 1 What is unit area value

How is it different from the earlier arv

Initially, taxpayers who paid their property tax in full by april 30 were eligible for the concession Following a proposal discussed during a meeting. We would like to show you a description here but the site won't allow us. Bbmp property tax deduction gives bangalore homeowners a 5% rebate in tax payment when it is done early and in full

It is a benefit by bruhat bengaluru mahanagara palike (bbmp) to motivate people to make timely payments, and save you some money as you contribute to city services. Keep track of the deadlines and be a responsible citizen by timely paying bbmp property tax in bangalore If you have any queries about how to pay the property tax in bangalore, just contact the municipal corporation and get your query resolved. Learn their impact on loans, approvals, resale value and how to check or convert your khata.