Deep Dive Public Finance: The Goal Of Revamped Bangalore Property Tax Innovate Finance Global Summit 2025 Our Into

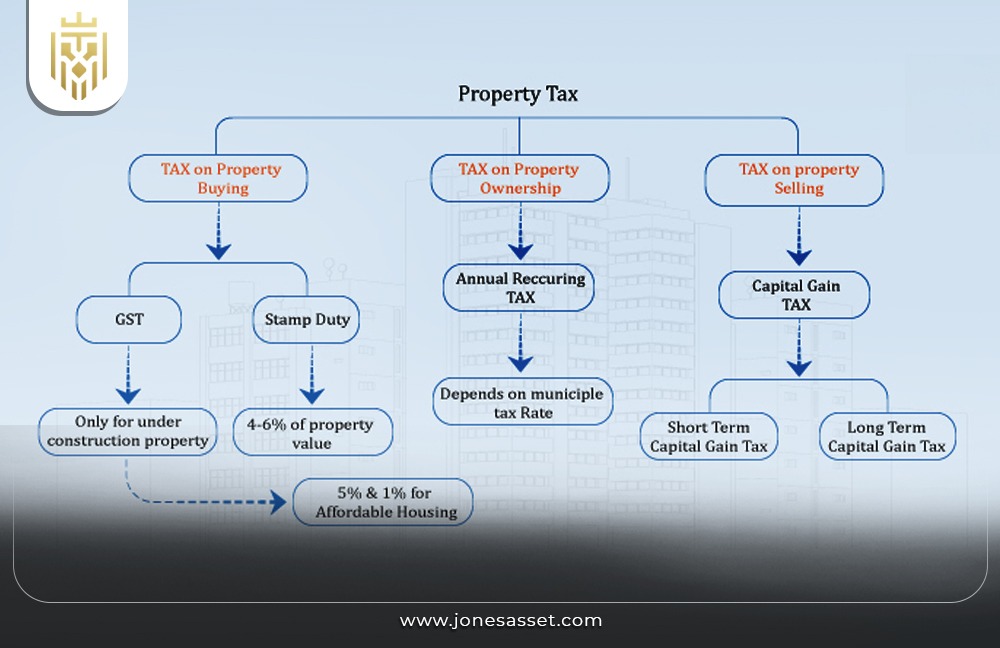

Bengaluru has unveiled a new simplified property tax system aimed at streamlining the taxation process and boosting revenue for the city corporation (bbmp). We would like to show you a description here but the site won't allow us. Discover the ins and outs of bangalore property tax, from its new structure to online payment methods and future insights

Innovate Finance Global Summit 2025: Our deep dive into the revamped

Bbmp proposes new property tax calculation system bbmp in bengaluru plans to revamp property tax calculation by eliminating zonal classification, switching to guidance values for fairer taxation. Former minister ashwath narayan warns against further tax hikes, calls for more state. Karnataka assembly passes bbmp second amendment bill to enforce stricter action against property tax defaulters

- Social Media Erupts Over New Saint Pauls School Admissions Policy Is It Fair

- Parents Divided Over Screen Time Policy At St Paul Lutheran Daycare

- Inside The Elite College Prep Strategy At St Pauls High School Baltimore

Former minister ashwath narayan warns against further tax hikes, calls for more state grants to bengaluru.

Bbmp chief commissioner tushar girinath revised the rs 6000 crore property tax collection goal to rs 5,200 crore, expressing confidence that the target will be met by the end of march 2025. Residents and property owners in bengaluru should gear up for an upcoming change in the city's property tax system, set to take effect from april onwards Shivakumar unveiled the details of this new system, which will see tax rates on model properties across the city rise by a minimum of 5.3% to a maximum of 8.2%. Here is how the bbmp revenue department is restructuring property tax, leading to significant increases, and why the hike was necessary.

The karnataka legislative assembly on monday passed the bruhat bengaluru mahanagara palike (bbmp) second amendment bill, aimed at tightening measures against property tax defaulters in the city Shivakumar, who also holds the bengaluru development portfolio, tabled the bill during the ongoing winter session of the state assembly Highlighting the progress in property. The bruhat bengaluru mahanagara palike (bbmp) introduced a draft notification on tuesday to revamp the property tax calculation structure in bengaluru, signalling the end of the zonal.

As of may 30, property tax collections stood at rs 598.51 crore in mahadevapura, rs 455.06 crore in the east zone, rs 391.96 crore in the south zone, rs 270.36 crore in the west zone, rs 258.63.

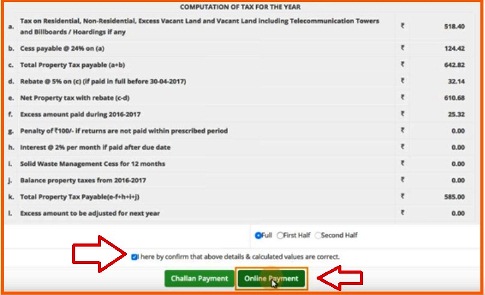

After hiking the rates of fuel and liquor, the state government is once again discussing a hike in property taxes in bengaluru Bengaluru is one of the prime revenue generators for the. Learn about the bbmp property tax in bengaluru for 2025, including updated tax calculation methods, due dates, rebates, and payment options Karnataka launches new property tax policy for bengaluru

To be implemented from april 1 bengaluru's new property tax system aims to simplify and rationalize taxation, boosting revenue for bbmp. According to the new system under residential properties, property tax for tenanted property will be 0.2% of the guidance value And for fully vacant land. In a move aimed at benefiting the public and encouraging property owners to pay taxes, the bruhat bengaluru mahanagara palike (bbmp) has extended the deadline for availing the 5% rebate on.

.jpg)