City Growth Strategy: Allocating Funds From Chennai Municipality Property Tax How To Pay Palakkad Online?

In addition to the economic benefits, the property tax collection drive is a crucial component of the city's broader fiscal health The increased mft will distributed from the transportation renewal fund (trf) In part 1 and part 2 of our present focus on municipal finance, we learnt about the sources of funds for the greater chennai corporation (gcc) and the strategies adopted by the civic body recently to increase the collection of property tax in the city

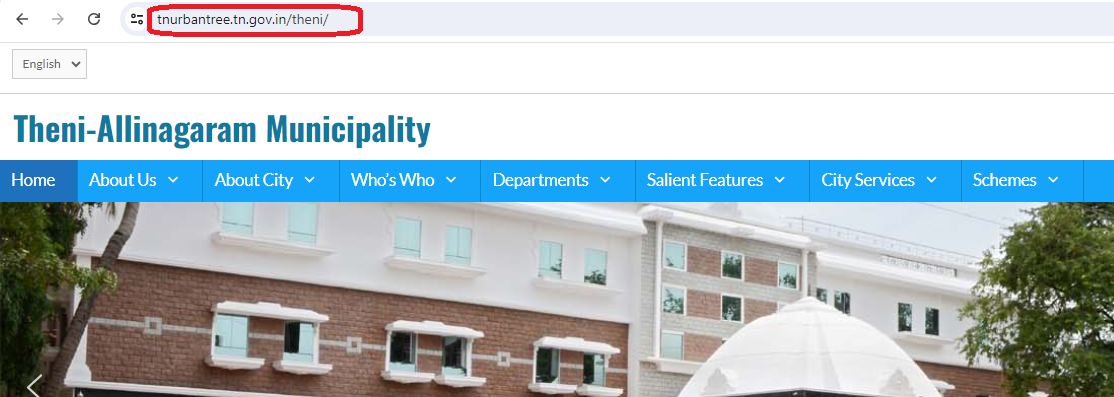

Theni Municipality Property Tax Online Payment: Tax Calculation

Property tax is a complex subject. The original mft will be distributed from the motor fuel tax fund (mftf) The property tax hike has broader implications for chennai's real estate market

- Inside The Elite College Prep Strategy At St Pauls High School Baltimore

- Viral Drone Footage Shows The Branch Kampe 2026 Green Belt Success

- The Unseen Twist How Orphan First Kill Changed Its Original Ending

The city's property market has historically been attractive to investors, thanks to its robust infrastructure and industrial growth

However, repeated tax hikes can erode investor confidence, particularly in the residential segment. Greater chennai corporation to propose 6% property tax increase at council meeting due to fund crunch and government order. The chennai city partnership project (ccp) has been envisaged by the government of tamil nadu (gotn) in association with the international bank of reconstruction and development (ibrd) or the world bank, which brings both financing and knowledge of the bank to support the transformation of the capital city of chennai. Explore comprehensive municipal finance data of chennai including revenue sources, property tax collection, expenditure patterns, debt profile, credit ratings and other fiscal indicators

The chennai corporation has recently announced a 6% increase in property tax, a strategic decision aimed at enhancing the city's revenue streams This move is part of a broader initiative to address the escalating costs associated with urban development and infrastructure maintenance as chennai continues to grow and urbanize rapidly. Every property owner in chennai—whether residential, commercial, industrial, or vacant land—must pay this tax regardless of whether the property is occupied or generating income They are also engaged in regulating, developing, facilitating and collaborating for the growth of the urban area

To undertake service delivery and developmental projects in the city, adequate allocation of municipal finances for smooth functioning is necessary

City governments allocate expenses on a list of services. Ltimindtree is a global technology consulting and digital solutions company that enables enterprises across industries to reimagine business models, accelerate innovation, and maximize growth by harnessing digital technologies. Missingmoney is a free and secure website endorsed by the national association of unclaimed property administrators (naupa) to search for and claim financial assets that have become inactive and turned over to state unclaimed property programs as required by law for safekeeping. Investment in mutual funds and sip made easy with edelweiss mutual fund, a leading asset management company (amc) in india

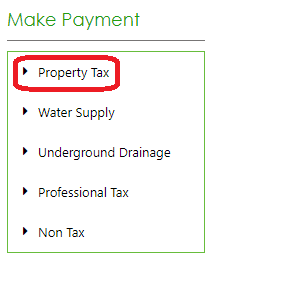

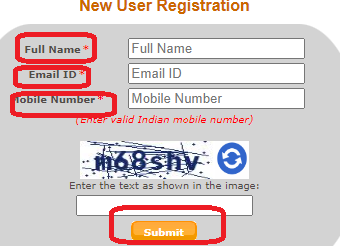

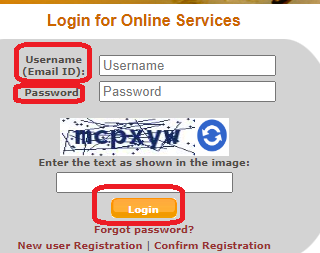

Start your investment journey with edelweiss mf. Property tax online payment please ensure the property tax bill no Before making payment search by existing bill number general revision new bill number zone no division code As a professional, though we use interchangeably we must know the me otal cost is constituted

Thus cost accounting is classifying, recording an appropriate allocation of expenditure for the determination of the costs of products or services, and for the presentation of suitably arranged data for the purpose of.

Dcb bank offers a range of banking services including current & savings accounts, fixed deposits, debit cards, and loan solutions to meet all your financial needs. *** assess your property tax on your own The pennsylvania treasury department protects $150+ billion of public funds, returns unclaimed property, manages the pa 529 college and career savings program, and much more. Explore top linkedin content from members on a range of professional topics.

Use tax increment financing subsidies, which are used for both publicly subsidized economic development and municipal projects, [2] 2 have provided the means for cities and counties to gain approval of redevelopment of blighted properties or public projects such as city halls, parks, libraries etc. Unbiased research on mutual funds, stocks & personal finance Tools, ratings, and expert advice to help you invest smarter.

Explore the booming indian real estate sector

Learn about trends in luxury residential, retail, and residential real estate markets What's driving growth in 2024? Invest in our equity funds , hybrid funds, etf's, fixed income funds & fund of funds. Monthly mft the motor fuel tax (mft) law was amended, effective july 1, 2019

There will now be two monthly mft allotments