International Shipping Data: Why How Many Ml Is Oz Affects Liquor Taxes In Archives 9jafoods

Learn how customs duties and taxes for alcoholic beverages are calculated See the instructions and cost and declarations forms below. Understand the factors involved and the impact of abv and alcohol content

NPs Concentration Affects the Filtrate (ml) | Download Scientific Diagram

Discover the classifications and taxes for beer, wine, spirits, fortified wines, and liqueurs Or 288 ounces of beer Get insights into customs duties and excise taxes, as well as additional charges and considerations.

- Viral Family Stories Praise St Pauls House A Lutheran Life Community

- Unpacking The Strategy Why St Pauls Childcare Embraces Holistic Development

- Market Shock Unexpected Drop In Key Inflation Number Stuns Analysts

Learn about customs duties and taxes on imported alcoholic beverages

Understand the costs and fees to make informed decisions when importing your favorite drinks. Requirements for importing alcohol for personal use shipping alcoholic beverages by mail is prohibited by united states postal laws The importer must be 21 to bring alcoholic beverages into the united states. The new tariffs are complicating international tax compliance for a lot of industries, and the u.s

Beverage alcohol industry may be particularly hard hit What are the beverage alcohol tariffs How do customs duties on alcohol impact the alcohol industry How do alcohol tariff changes in 2025 affect beverage alcohol producers?

This information is being presented to help the public to understand and comply with the laws and regulations that the alcohol and tobacco tax and trade bureau administers

It is not intended to establish any new, or change any existing, definitions, interpretations, standards, or procedures regarding those laws and regulations In addition, this presentation may be made obsolete by changes in. Specific references to 19 u.s.c § 1321 clarify how (and whether) de minimis shipping thresholds (i.e., small parcels) remain duty‐free

Initially, the administration revoked duty‐free de minimis treatment for many goods, including alcohol, but subsequent amendments (e.o 14226 and 14227) restored it conditionally. Ps international alcohol shipping guide It is the shipper's responsibility to know and comply with all appli every alcohol shipment's commercial invoice description and alcohol label requires the following information, and in addition, items listed below for the specific country:

Understanding duties and taxes it's important to consider the effects of duties, taxes and other clearance charges when determining an international shipment's total cost (also known as the landed cost)

Depending on the shipment content and the destination country, clearance charges could significantly impact the total shipment cost. Free us import duty & tariff calculator Calculate customs fees, taxes & duties by hts code Learn how customs duties and taxes on international shipments work including calculations, regulations, and tips to manage costs effectively for smooth shipping.

Learn all the florida alcoholic beverage laws, sales, and market trends today We cover regulations, statistics, and wholesalers as well. Office of the attorney general division of alcoholic beverage control We would like to show you a description here but the site won't allow us.

The sales data refer to the revenues received by liquor authorities and their agents, and a portion of these revenues include sales to licenced establishments such as bars and restaurants, some of which would be considered as business intermediate expenses.

There are two types of spirits (liquor) taxes A spirits sales tax and a spirits liter tax Spirits sales tax is based on the selling price of spirits in the original package The rate paid by the general public is 20.5%

Spirits (hard liquor) sales tax what is the spirits sales tax The spirits sales tax is a tax on the selling price of spirits in their original container The term spirits includes any beverage containing alcohol obtained by distillation, including wines with more than 24 percent alcohol by volume What is the spirits sales tax rate?

The data is as of july 2024 and it is expected to continue to be collected in the future on a biennial basis

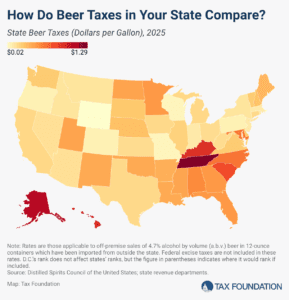

This work aims to help understand the global implementation of taxes on alcoholic beverages, measure their level and identify areas of improvement First, increases or decreases in the hours of sale affect consumers' ability to purchase alcohol by changing its availability. In response to tariffs president donald trump levied on canada, ontario issued an stop purchase of us beverages Here's how it impacts kentucky.

This quick and simple primer to the calories, carbs, and sugar in beer, wine, and hard liquor makes it easy to choose a drink that works with your weight loss plan. Alcohol measurements are units of measurement for determining amounts of beverage alcohol Alcohol concentration in beverages is commonly expressed as alcohol by volume (abv), ranging from less than 0.1% in fruit juices to up to 98% in rare cases of spirits A standard drink is used globally to quantify alcohol intake, though its definition varies widely by country

An exemption from washington state liquor taxes and fees for personal use or household use is limited to once per calendar month

Washington state liquor taxes and fees must be paid for amounts in excess of 2 liters of spirits, wine, or hard cider