Market Valuation Data: Why The Billion To Crore Shift Matters For Startups Rameshwaram Cafe Net Worth Rs 50 Annual Turnover

The shift in investor expectations over the past two decades, investor expectations for tech startups have evolved significantly Discover 6 innovative startups that achieved unicorn status in 2024, crossing the $1 billion valuation milestone with unique strategies. Initially, the focus was on market disruption and growth potential

$600 billion stock market shift to New York feared

In the meantime, the number of billion dollar startups has increased, but not quickly enough to keep pace with the increase in capital Not only does it provide an average pre money valuation, but most importantly, it gives an understanding of the fundamental value of the startup and its idea, brand value on the market, team and product's potential, and the context of fundraising. This supply demand imbalance is also leading to an increase in startup prices, further decreasing the time to $1 billion in valuation

- St Paul Lutheran Church Catonsville Md 2026 Youth Hub Opens Early

- Viral Family Stories Praise St Pauls House A Lutheran Life Community

- New Data Reveals Surprising Academic Gains Across Schools In Glen Burnie

Some startups are growing faster than ever before.

Even with market corrections, unicorns are still being minted at a steady clip In the first three quarters of 2024 alone, 67 startups surpassed the $1 billion valuation mark While the pace may not match the frenzied highs of 2021, it signals ongoing investor confidence in companies with the right mix of traction, innovation, and market. The research question is articulated based on the research gap analysis conducted during literature review

Do outside funds and increased access to capital have an effect on the market valuation of technology startup firms A startup valued at $1 billion may only have a few months of runway When funding slows or markets shift, the gap between valuation and reality becomes fatal. Startup valuation is often seen as just a number reflecting a company's worth

But for startup founders, its much more than that

Valuation impacts nearly every aspect of a startups journey, from. In the world of startups, achieving a $1 billion valuation—becoming a unicorn —is the holy grail While many companies strive for this milestone, only a few manage to get there From deeptech to green fintech, and from synthetic biology to decentralized platforms, a new breed of startups is emerging.

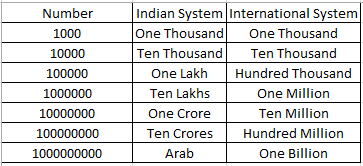

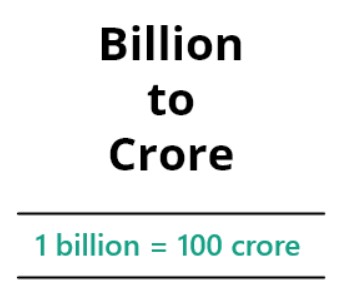

So even if a company lists at inr 2, 000 crore, it will still land in the country's top 25 % of publicly traded companies How are startups worth billions of dollars Doesn't this violate all the principles of valuation? we get questions like the ones above all the time Why startup valuation matters valuation affects nearly every strategic decision a founder makes

Equity and ownership a higher valuation means founders give away less equity for the same amount of capital

With a lower valuation, they lose more ownership Founders must protect their equity while raising enough money to fuel. The fusion of innovation, investment, and collaboration is crafting a landscape where startups flourish, industries evolve, and the nation rises to unprecedented heights on the global platform. As per a report from redseer, what took 18 years in 2000 to reach $100 million revenue has come down to five years.

Infra.market, which recorded ₹379 crore profit in fy24 and revenue worth ₹14,530 crore, has raised $751 million in total funding, with $121 million secured in january 2025 at a valuation of $2.8 billion. The valuation, therefore, has elements of scarcity, elements of future promise, and hope that these companies would be picked up at an even higher valuation in the future. Technologies that involve big data, clean tech, mobile and augmented reality are prominent equity valuation premiums, regardless of the subsectors in which the startups originate What are the key considerations vcs use in startup valuation

How can founders optimize their companies' value

What are the current market levels? Why is startup valuation important For an entrepreneur, startup company valuation matters for various reasons Accurate valuation affects financial outcomes and shapes the startup's success, relationships with investors, and overall strategic direction.

The company, a leading logistics provider in india, has also expanded its services and market share, particularly in areas like prime solutions and quick commerce, where it holds over 50% market share If 2023 performance is any guide, the market may record a sub $100 billion year in 2024 A few disruptive deals could change that outlook, but we are not returning to the exuberance of the bull run market anytime soon. Valuation analyzes current and past performance and operates with financial data and statistics