The Chennai Resident Debate: Transparency In Property Tax In Chennai Corporation Calculator Onle Gcc

Chennai residents are set to face a 6% property tax increase from october 1, 2024, stirring controversy and concern over the financial burden amid rising living costs According to a press release, people can pay the property tax on the. Opposition councillors propose alternative solutions, while the greater chennai corporation defends the hike as necessary for financial stability.

Chennai corporation raises property tax by 6%, oppn sees red | Chennai

Misleading information circulating on social media about fake property tax rebate for senior citizens in chennai corporation. The greater chennai corporation has requested property tax assessees to pay before october 15 and get a 5% incentive Chennai corporation is considering a 6% property tax hike to address financial strain, impacting the real estate market

- The Great Debate Parents React To Saint Paul Schools 2026 Homework Policy Shift

- Year Round Learning Modules Reshape The Glen Burnie High School Calendar

- Academic Excellence Initiatives Define The Future Of St Pauls Christian School

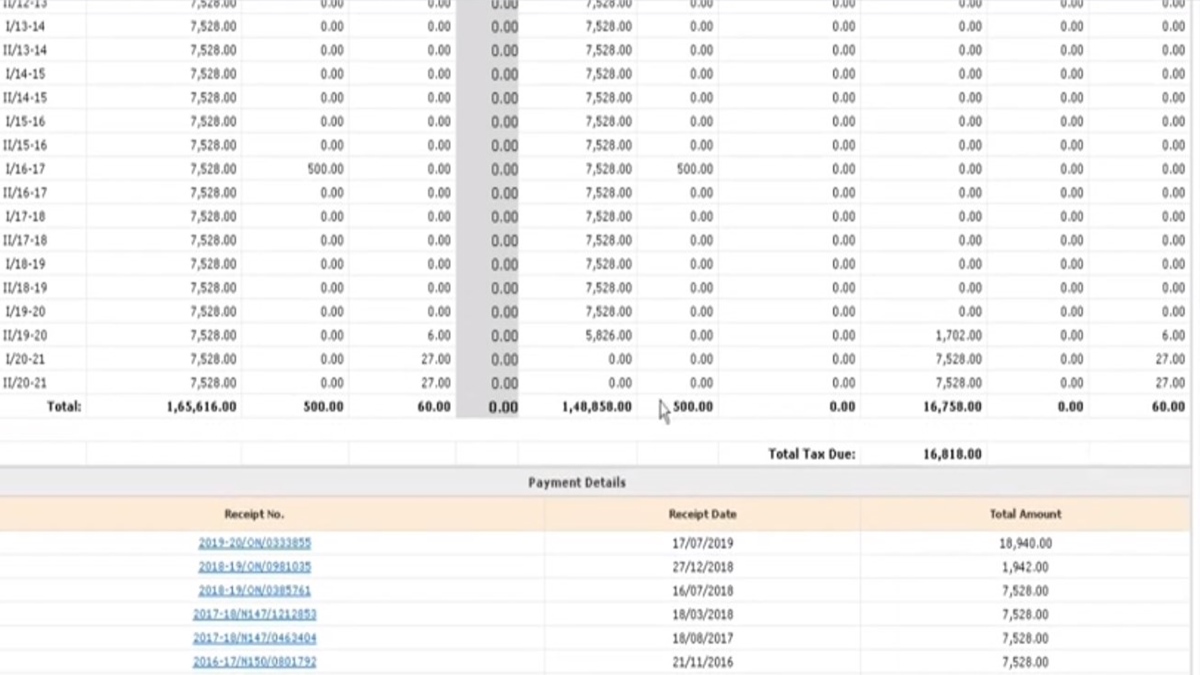

Here is an explainer of how the revenue department of the gcc is calculating the revised property tax amounts and why a hike was crucial

The tamil nadu government increased property tax for all local bodies in the state earlier this april This means that the residents of chennai's core areas. The new tamil nadu urban local body rules 2023 permit the greater chennai corporation (gcc) to raise property tax by six per cent or by the average growth rate of the state's gross state domestic product (gsdp), whichever is higher For the present fiscal, this comes into effect from october 1, the resolution moved by chennai mayor r priya noted.

The greater chennai corporation (gcc) is preparing to increase property taxes by 6%, marking the first revision in two years since the significant hike implemented in 2022 As per sources, the proposal for the increase is expected to be tabled during an upcoming council meeting, a move that is seen as necessary to address the civic body's financial strain While the decision aims to generate. The greater chennai corporation has sanctioned a 6% property tax hike, projected to yield an extra 105 crore annually

Despite protests from various councillors, this move complies with the union.

The city corporation has passed a resolution to increase property tax rates by 6% on an annual basis as per the tamil nadu urban local bodies rules, 2023. The greater chennai corporation (gcc) council passed a resolution to hike property tax in the city by 6%, on friday, september 27 While a majority of those in favour of the resolution were dmk. The alliance of residents' welfare associations (aorwa) in chennai is protesting a recent 6% property tax hike by the greater chennai corporation, urging the state government to prioritize civic.

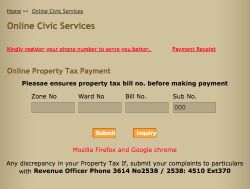

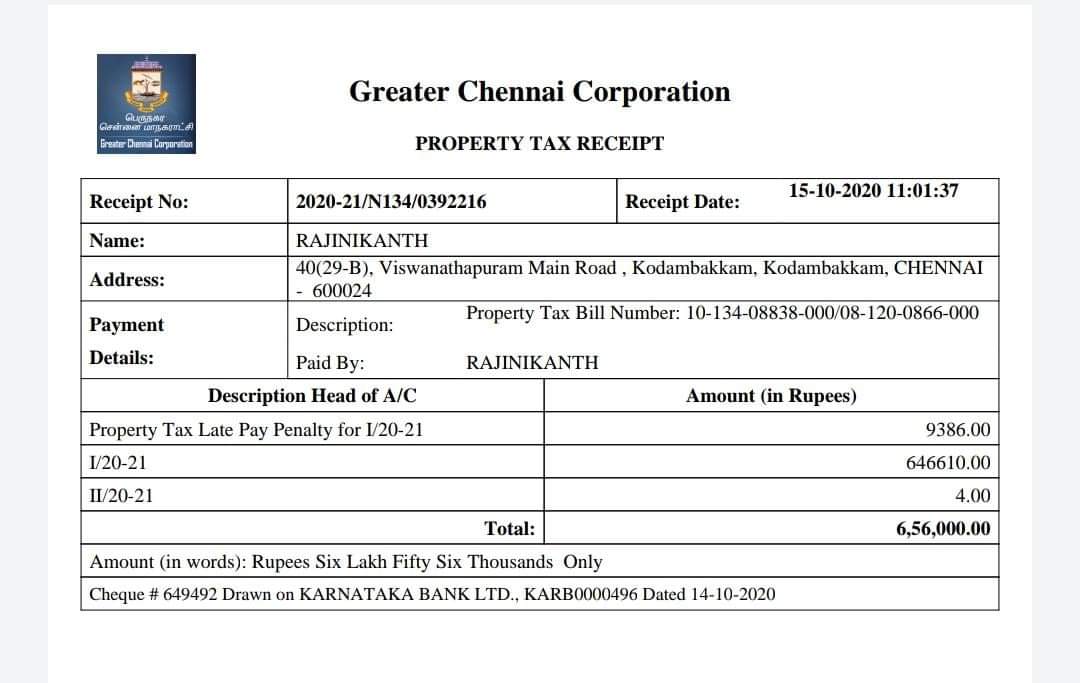

Online property tax receipt please ensure the property tax bill no Property tax status please ensure the property tax bill no Know how to calculate chennai property tax using property tax calculator, how to make online payment and what are the rebates offered. Please wait.search by acknowledgement no ptnan

Cmwssb pay your metro water tax cmwssb visit

This video is about how to register or update mobile number in property tax online tamil#propertytax#mobilenumber#registration#update#online#chennai#email#ra. The greater chennai corporation has slashed the penalty on late payment of property tax from 2% to 0. We would like to show you a description here but the site won't allow us. Lafayette parish assessor homestead exemptions the state constitution allows a homestead, consisting of a tract of land or two or more tracts of land with a residence on one tract and a field on the other tract or tracts, not exceeding 160 acres, owned and occupied by a person, or persons owning the property in indivision, to be exempt from state, parish, and special ad valorem taxes to.

![Chennai Corporation Property Tax Calculator Online [GCC]](https://www.recruitmentzones.in/wp-content/uploads/2022/07/Chennai-Corporation-Logo.jpg)