The Fintech Twitter Debate: Explaining Billion To Crore To New Investors Trappyboi On "@banana Eateryum @orcdezon1 @dream

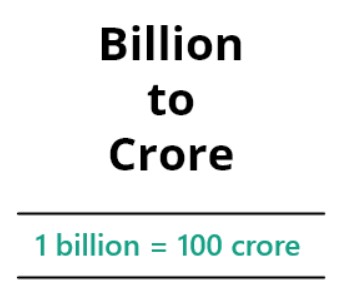

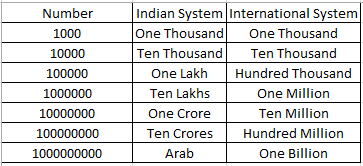

Twitter has begun applying for regulatory licences across the us and designing the software required to introduce payments across the social media platform, as elon musk searches for new revenues. Asia, australia & new zealand, and canada together accounted for about 10.5%. Elon claims payments will generate as much as $1.3 billion in revenue by 2028

The FinTech Bloodbath - Chris Skinner's blog

Twitter has become the latest tech giant to join the fintech gold rush. The united states continued to dominate as the top market with us$ 103.2 billion (54.1%) of exports, followed by europe at us$ 58.8 billion (30.8%), including the united kingdom at us$ 26.8 billion (14.1%) Boston —global fintech is entering a new era of maturity and momentum

- St Pauls Cathedral New 2026 Restoration Project Reveals Roman Foundations

- Market Shock Unexpected Drop In Key Inflation Number Stuns Analysts

- The Grand Avenue Project Charting The Next Decade For St Paul

According to a new report from boston consulting group (bcg) and qed investors , fintech's next chapter

Scaled winners and emerging disruptors , the sector has emerged from a tough funding environment stronger, more disciplined, and with greater growth prospects than ever. Here's your definitive guide to the 20 fintech influencers on x (formerly twitter) who are shaping the financial landscape — and why following them can sharpen your perspective in 2025. Executive summary over the past decade, technological progress and innovation have catapulted the fintech sector from the fringes to the forefront of financial services And the growth has been fast and furious, buoyed by the robust growth of the banking sector, rapid digitization, changing customer preferences, and increasing support of investors and regulators

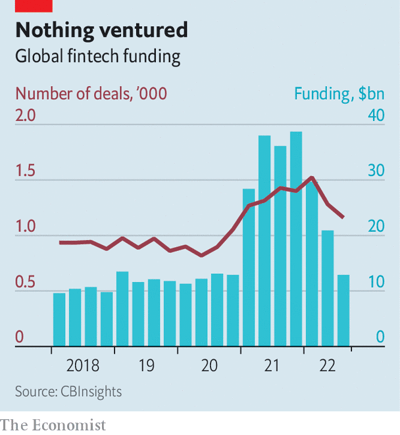

Elon is talking about turning his $44b twitter purchase, with its 400mm monthly active users, into a fintech with a payments and banking offering We take apart the underlying strategy, and discuss the value chain that starts in social media, moves into commerce and payments, and then ends in banking and investments. Biannual analysis of global fintech funding The impact of higher interest rates on the cost of capital and expectation of returns has removed more speculative investing and reset fintech investment to a new baseline

While fintech investors were cautiously optimistic entering.

This article is part of fintech leaders, a newsletter with 50,000+ dreamers, entrepreneurs, investors, and students of financial services I invite you to share and sign up! Elon musk, the entrepreneur known for his bold business moves, envisions transforming twitter into a comprehensive financial services platform This is not the first time a tech giant has attempted to enter the financial sector, as facebook, google, and amazon have all made similar efforts, facing regulatory challenges and competition

Musk's proposed x app aims to connect twitter's. Ever since elon musk acquired twitter for $44 billion on october 27, speculation has resurfaced on twitter and traditional media around how the billionaire plans to transform the social network Musk's earlier tweet offered a clue Buying twitter is an accelerant to creating x, the everything app

At the end of last month, he shared more information of his view on twitter's future as.

Note nse exclusive data and combined fii / fpi & domestic institutional investors (dii) trading data across bse, nse and msei is collated based on trades executed by fiis / fpis and diis The fii/fpi data is based on today's activity compiled based on pans provided by nsdl. Automatically create bibliographies, references, and citations in apa, mla, chicago, harvard, and more with our fast and free citation generator. Some of the most respected investors in the fintech space have backed groww's vision of democratising investing in india

In october 2021, groww raised series e funding of $251 million at a valuation of $3 billion This investment was led by iconiq growth along with other investors including alkeon, lone pine capital, and steadfast. Explore foreign direct investment in india, fdi trends, inflows, key sectors, reforms, and initiatives that shape india's investment ecosystem. We help the daring build legendary companies from idea to ipo and beyond.

It provides overall direction to the organisation in many ways and includes specifying the organization's objectives, developing policies and plans designed to accomplish these objectives, allocating resources.

The fintech world has a new heavyweight In february 2020, afterpay was reported to have 3.6 million active customers in the us, 3.1 million in australia and new zealand, and 600,000 in the uk. Harish reddy, saurabh jain founded in Lightspeed india partners, matrix, titan capital india's fintech landscape continues to flourish, with promising startups like stable money making waves in the sector

Stable money is a unique platform designed for investing in fixed deposits (fds). Flipkart stated that it would use appiterate's technology to enhance its mobile services Flipkart bolstered its supply chain and. Techcrunch | reporting on the business of technology, startups, venture capital funding, and silicon valley

[6] stripe is the largest privately owned fintech company with a valuation of about $107 billion and over $1.4 trillion in payment volume processed in 2024

The free press journal thursday, december 18, 2025| vol A 360 degree business spend management platform, automating workflows like employee benefits, rewards and recognition, expense management, and integrating with any payment instrument.