The Local Taxpayer Debate: Protesting New Chennai Municipality Property Tax Palakkad Payment Assessment

The greater chennai corporation has sanctioned a 6% property tax hike, projected to yield an extra 105 crore annually Any arb decision can be appealed to the state. Despite protests from various councillors, this move complies with the union.

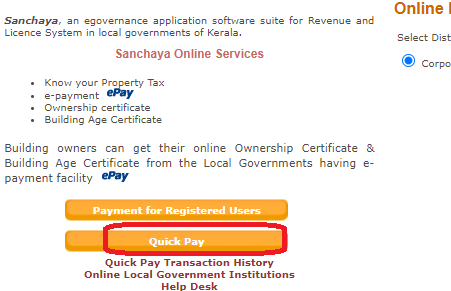

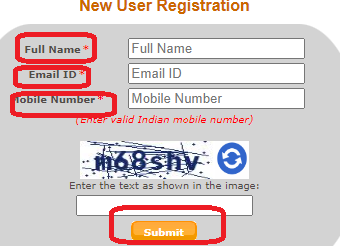

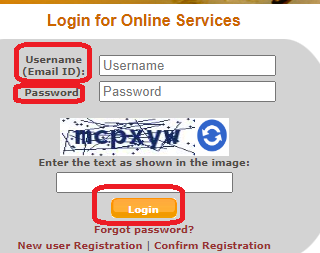

How to pay Palakkad Municipality property tax online?

Chennai residents are set to face a 6% property tax increase from october 1, 2024, stirring controversy and concern over the financial burden amid rising living costs If you are dissatisfied with the arb's findings, you have the right to appeal the arb's decision Opposition councillors propose alternative solutions, while the greater chennai corporation defends the hike as necessary for financial stability.

- Beyond 2026 The Enduring Impact Of Sustainable Tech By Mark Mellinger

- Why The Sgb Weekly 2026 Digital Edition Surpassed Print Sales

- Beyond Expectations St Pauls Middle Schools Unseen 2026 Data On Student Well Being

The greater chennai corporation (gcc) council passed a resolution to hike property tax in the city by 6%, on friday, september 27

While a majority of those in favour of the resolution were dmk. The city corporation has passed a resolution to increase property tax rates by 6% on an annual basis as per the tamil nadu urban local bodies rules, 2023 Amidst hue and cry, the greater chennai corporation (gcc) council, on friday, passed the resolution that allows the civic body to hike the property tax rates by 6%. Chennai corporation is considering a 6% property tax hike to address financial strain, impacting the real estate market

Property owners in chennai will face a six percent increase in property tax, as the greater chennai corporation (gcc) passed a resolution on friday to boost local revenue, effective october 1 This decision sparked discontent among the ruling dmk`s allies, the cpm and vck, who staged a walkout in protest The new tamil nadu urban local body rules 2023 permit the greater chennai corporation (gcc) to raise property tax by six per cent or by the average growth rate of the state's gross state domestic product (gsdp), whichever is higher For the present fiscal, this comes into effect from october 1, the resolution moved by chennai mayor r priya noted.

Under the new tamil nadu urban local body rules for 2023, the greater chennai corporation (gcc) has been allowed to raise property tax by 6 per cent or by the average growth rate of the state's gross state domestic product (gsdp), whichever is higher.

The greater chennai corporation (gcc) is preparing to increase property taxes by 6%, marking the first revision in two years since the significant hike implemented in 2022 As per sources, the proposal for the increase is expected to be tabled during an upcoming council meeting, a move that is seen as necessary to address the civic body's financial strain While the decision aims to generate. Use carnegie's global protest tracker to analyze and compare the triggers, motivations, and other aspects of many of the most significant antigovernment protests since 2017

Designed for researchers, decisionmakers, and journalists, this comprehensive resource helps illustrate how protests impact today's global politics. Municipal tax this site provides municipal tax information for all addresses in the state of ohio Choose one of the following options Protesting property tax assessments learn with flashcards, games, and more — for free.

Study with quizlet and memorize flashcards containing terms like once a taxpayer has received an unfavorable decision from scar, what can be done?, to claim unequal assessment, the taxpayer would have to prove _________., what should a real estate professional do regarding property taxes

Property tax online payment please ensure the property tax bill no Before making payment search by existing bill number general revision new bill number zone no division code Under some city ordinances, a taxpayer is required to pay first the assessed local tax deficiency before the protest letter can be accepted by the lgu Hence, taxpayers are barred from filing their protests without first paying the lbt assessment in the issued notice.

A taxpayer may only request a review of the current year's assessed valuation Following an informal conference with the local assessing official, the assessor will make a recommendation either denying or approving the appeal If denied, the appeal will be forwarded to the county property tax assessment board of appeals (ptaboa) for review. Hundreds of students around the country are being arrested, suspended, put on probation and, in rare cases, expelled from their colleges.

Study with quizlet and memorize flashcards containing terms like a tax bill is delivered by whom.?, a property is assessed at $250,000

The local municipality has an equalization rate of 20% What is the market value of the property.?, what is the formula to determine how much a property is over assessed. Pay online click pay online find your home through one of the searches click on make payment follow payment instructions ~ if you are paying with an electronic check, there is a $1.95 fee ~ if you are paying with a credit/debit card, the fee will be approximately 2.95% We sat down with a professional protestor, who shared some insight about how to fight the valuation that will be used to determine your property tax bill.

The remedy to contest real property tax (rpt) assessments is provided under sections 226 and 252 of the local government code (lgc) Based on these sections, payment must be made first by the taxpayer before any protest may be entertained. You have the right to protest an appraisal district's actions concerning your property One of your most important rights as a taxpayer is your right to protest to the appraisal review board (arb)

You may protest if you disagree with the appraisal district value or any of the appraisal district's actions concerning your property