The Wealth Tax Debate: Economists Analyze Billions To Millions Reporting Asian Businessman Brainsrming Financial Sck Pho

This report examines the issues and challenges of adopting a wealth tax in the united states and illustrates how varying the tax base, thresholds, and rates of a wealth tax would affect federal revenues and the taxes paid by households at various income levels. And $200 billion globally by 2025. The proposal would levy a 2% tax on net wealth above $50 million plus a 1% surtax on wealth over $1 billion

The Wealth Tax Debate and Latest Insights from the Virginia Automotive

Annual estimates for this proposal range from $117 billion (smith, zidar, and zwick) to $300 billion (saez and zucman). The vice president rolled out new economic proposals aimed at black men as she courts their vote. The pwbm projection analyzes a plan that would tax household net worth above $50 million at a rate of 3 percent

- Diversified Recruitment Strategies Define The Legacy Of St Pauls Admissions

- New Study Reveals Unseen Link St Paul Allergy Spike Tied To Urban Green Spaces

- Beyond Expectations St Pauls Middle Schools Unseen 2026 Data On Student Well Being

That's slightly different from warren's plan, which would impose a 2 percent tax on household wealth over $50 million and a 6 percent tax on wealth above $1 billion.

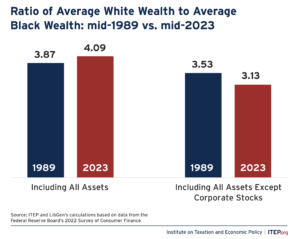

If enacted, the tax could bring in more than half a billion dollars of tax revenue over the next decade. The top 1% of us households now own 40% of the country's wealth in a new book, economists emmanuel saez and gabriel zucman of the university of california, berkeley, who have advised warren, claim that her tax would tackle growing wealth concentration in the us and yield some $250 billion per year, or 1.2% of gdp But critics such as larry summers, a former us secretary of the treasury under. The bigger and more unequally distributed the stock of existing wealth (relative to potential future wealth accumulation), the less bad an annual wealth tax looks from the point of view of economic efficiency

A federal wealth tax on the top 0.1 percent of households could raise significant tax revenue, curb growing economic inequality and help make the tax system fairer, a new report released today by the institute on taxation and economic policy (itep) finds. In america, president joe biden floated the idea of a tax on unrealised capital gains, which would have been a wealth tax of sorts Economists are aware of the problems such taxes face. The debate over whether the united states should adopt a wealth tax has gained prominence in recent years as a potential solution to address rising wealth inequality and generate additional government revenue

As reported by the peter g

Peterson foundation, a wealth tax would impose a levy on the total value of an individual's assets, including cash, investments, real estate, and other. Henry makow's official web site Exposing feminism and the new world order Comprehensive ap world history textbook covering 1200 to present, with units on global tapestry, networks, empires, and more

Includes practice exams and historical analysis. Some labor advocates and economists say the rule change would push wages down for both u.s The economic policy institute estimates the revised wage methodology could reduce total u.s Farmworker pay by about $3 billion a year—roughly 9% of total wages.

Meanwhile, some big names have been ranked among the worst energy suppliers.

In recent remarks, vice president kamala harris has cited several economic analyses, claiming they found her plan would strengthen the economy and former president donald trump's plan would. Tax units with less than $1 billion and more than $50 million in net wealth owned $9.2 trillion, a number not dissimilar to the one found in the survey of consumer finances, $10.2 trillion. Ani brings the latest news on politics and current affairs in india & around the world, sports, health & fitness, entertainment, news. [3][4] economics focuses on the behaviour and interactions of economic agents and how economies work

Microeconomics analyses what is viewed as basic elements within economies, including individual agents and markets, their interactions, and. A massive surge in billionaire wealth threatens our everyday lives and economy, from the rights of workers to the stability of the social safety net. The mass deportation of millions of undocumented individuals would be tremendously expensive and would have a catastrophic impact on our economy—one that would be expansive and impact every american The american immigration council analyzes the fiscal costs and economic impacts of such a mass deportation operation.