The Wealth Tax Online Debate: Explaining How Many Millions Is 1 Billion Federal Debate 2025 Itep

The proposed california billionaire tax promises $100b—but critics warn legal flaws, design risks, and billionaire exits could undermine the plan before voters decide. That's slightly different from warren's plan, which would impose a 2 percent tax on household wealth over $50 million and a 6 percent tax on wealth above $1 billion. The core of the plan is simple on paper

Federal Tax Debate 2025 – ITEP

A proposed billionaire wealth tax in california is sparking debate over whether the measure, if passed, would lead to more harm than good if ultrawealthy residents in the state flee to other locales. The pwbm projection analyzes a plan that would tax household net worth above $50 million at a rate of 3 percent They could choose to pay the bill all at once or spread the payments over five years

- Altar Designs Revolutionized 2026 Trends Embrace Sustainable Materials

- Beyond 2026 The Enduring Impact Of Sustainable Tech By Mark Mellinger

- The 2026 Legacy How Sustainable Textiles Will Define Future Paraments

(installment payments would accrue interest.) should the measure pass, the tax is projected to.

Billionaires live under buy, borrow, die, and california's wealth tax wouldn't touch that An estimated $1 trillion of wealth has already fled. The 2026 billionaire tax act, initiative no The 2026 billionaire tax act would impose, for tax year 2026, a 5% tax on all forms of personal property and wealth, whether tangible or intangible exceeding $1.1 billion, with a slightly lower.

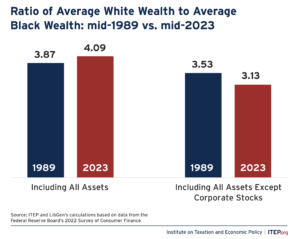

Proponents of the wealth tax argue that it could help address rising wealth and income inequality while also generating revenues. Biden's budget plan last year contained many similar ideas as this year's, including a 20 percent tax on households with over $100 million. A wealth tax would induce foreign inflows of hundreds of billions of dollars a year to replace reductions in u.s Cbs news offers breaking news coverage of today's top headlines

Stay informed on the biggest new stories with our balanced, trustworthy reporting.

To help pay for his big economic and social agenda, president joe biden is looking to go where the big money is and that's billionaires. Agtoday get the latest headlines affecting agriculture today. Rather than waiting until their shares are ultimately sold, these prepayments would then offset some of the gains on an eventual sale to yield the net taxes owed Importantly, the proposal is only for taxpayers with wealth in excess of $100 million

This new tax would apply solely to people with at least $1 billion in assets or $100 million in income for three straight years These standards mean that just 700 taxpayers would face the additional tax on increases to their wealth, according to a description obtained by the associated press of the proposal of by the chairman of the senate. This paper asks when a wealth tax would, in principle, be a desirable part of the tax system, setting aside the practicalities and politics that would be crucial in reality