Venture Capital Strategies: The Mathematical Logic Of Billions To Millions Meet Winter Mead On Fundraising Demystified Coolwater Posted

A practical toolkit for startup valuation logic let's start with the simplest math in venture Those aspiring to raise a fund, pursue a career in venture capital, or simply understand the art of investing can benefit from the business of venture capital, second edition. Suppose a founder raises $6 million in exchange for 6% of their company

Venture Capital Advisory and Insurance - Newfront

But these numbers don't tell the whole story We got to talking about the venture capital asset class and it wasn't long before we got to the math problem When a vc puts in money, they're rarely just buying.

- The 2026 Legacy How Sustainable Textiles Will Define Future Paraments

- New Data Reveals Surprising Academic Gains Across Schools In Glen Burnie

- The Shocking Truth Behind St Pauls Admissions 2026 Sees Record International Surge

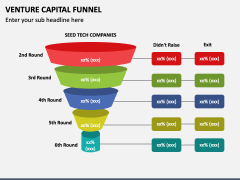

From 50 bets to 1 billion in 2011, sequoia capital invested $8 million at a $60 million valuation in whatsapp

Four years later, facebook acquired the company for $19 billion. We then outline six common methods vcs use to value startups, from the dilution method to the vc method. finally, we'll explain valuation vs Price and how market conditions affect dealmaking Whether you're preparing for your first pitch or just want to understand vc.

Venture capital is an extremely precise risk calculation with expected returns and expected failures all rooted in some simple math — here is what those equations look like for every aspect of the vc process Raising and organizing a fund i think it goes without saying that a venture capital firm needs capital to invest. This blog condenses our learnings as founders that have raised millions and have been raising capital for more than 7 years We will break down the complex world of venture capital math and help you understand the key principles and metrics that drive investment decisions

Why understanding venture capital math matters

However, it's not just about intuition and gut feeling There is a significant amount of mathematics and financial modelling involved in making these investment decisions Understanding the core principles of venture capital math (vc math) can help. Photo by thisisengineering on unsplash in one of my entrepreneurship classes this semester, i was explaining how venture capital works

I was walking my students through the usual story — how investors raise funds from limited partners, make a series of bets on startups, expect most of those bets to fail, and hope a few outliers deliver big enough returns for the math to work But what does the data actually suggest about optimal portfolio construction for investors We've analysed 5,393 uk startups and over 300,000 investor records to build an interactive simulator that suggests the mathematical reality behind. Comprehensive 10th edition textbook covering business fundamentals, management, marketing, finance, and ethics for college students.

We also provide tools to help businesses grow, network and hire.

Ing from venture capital and private equity funds We also reviewed the portfolio plays of major internet companies, the dynamics in ai ecosystems from shen hen to new york, and a wide range of case studies As part of our primary research, we surveyed more than 3,000 senior executives on the use of ai technologies, their companies' prospects. Investopedia is the world's leading source of financial content on the web, ranging from market news to retirement strategies, investing education to insights from advisors.

I'll walk you through the math later, but for now, take a look at the effects of dilution Every round projected is an up round, or course, as we are forecasting success In 2020, he was estimated to have personally earned $2.6 billion, [33] $2.8 billion in 2007, [34] $1.7 billion in 2006, [35] $1.5 billion in 2005 [36] (the largest compensation among hedge fund managers that year), [37] and $670 million in 2004. Last year, andreessen horowitz collected $7.2 billion while general catalyst amassed $8 billion.

Andreessen horowitz just announced the firm has raised a little more than $15 billion in new funding

The haul represents over 18% of all venture capital dollars allocated in the united states in. We're on a journey to advance and democratize artificial intelligence through open source and open science.