Civic Leaders Explain The Infrastructure Gain When You Pay Property Tax Bbmp Ment Online Step By Step Guide! Sobha Ltd

The bengaluru civic body bruhat bengaluru mahanagara palike (bbmp) will use artificial intelligence to identify illegal constructions and streamline property tax collection, according to deputy chief minister and bengaluru development minister dk shivakumar. Calculate and pay your bbmp property tax online Bbmp property tax collection, which was once thought of as a bureaucratic task, is gradually evolving into more than just a formality

BBMP Property Tax - How to Pay Online, Offline (FY 2023-24)

These days, it's a very effective civic tool that you can use from the comfort of your browser to strengthen bengaluru's infrastructure, fund city services, and streamline payments. Bbmp property tax is a tax imposed on all properties in bangalore by the bruhat bengaluru mahanagara palike (bbmp), the civic body responsible for the administration of bangalore. The bbmp property tax payment is a crucial annual obligation for property owners in bengaluru

- Inside The Elite College Prep Strategy At St Pauls High School Baltimore

- Diversified Recruitment Strategies Define The Legacy Of St Pauls Admissions

- Year Round Learning Modules Reshape The Glen Burnie High School Calendar

Administered by the bruhat bengaluru mahanagara palike (bbmp), it funds essential civic infrastructure like roads, drainage, and parks

With the introduction of the bbmp online payment system via the bbmp tax portal, paying taxes has become seamless This guide covers everything from understanding. Bruhat bengaluru mahanagara palike (bbmp) levies an annual property tax on property owners in bengaluru It is paid to the municipal authority to fund infrastructure development, maintenance of civic amenities, and services like waste management, water supply, and road upkeep in the city.

The revenue generated supports civic amenities and infrastructure development across the city. The bbmp budget, under the 'brand bengaluru' initiative, aims to improve. The bruhat bengaluru mahanagara palike (bbmp) is the municipal governing body responsible for bengaluru's civic infrastructure and administration One of its primary revenue sources is property tax, which must be paid by owners of residential, commercial, and industrial properties within bengaluru city limits

This guide provides a detailed overview of bbmp property tax, including its.

Bbmp property tax is a mandatory annual tax levied by the bruhat bengaluru mahanagara palike (bbmp) on all property owners within its jurisdiction It is one of the key sources of revenue for bbmp and is used to fund civic amenities and public infrastructure. The bbmp uses the revenue collected from property tax to fund infrastructure projects, maintain civic amenities, and provide essential services such as waste management, road maintenance, and public health initiatives What are the key changes and updates in bbmp property tax rules

Bbmp property tax rules are subject to change. Understanding bbmp property tax rates and payment process in india, property tax is a vital source of revenue for local governments, facilitating the provision of essential services and infrastructure development In bangalore, the bruhat bengaluru mahanagara palike (bbmp) is responsible for assessing and collecting property taxes from property owners within its jurisdiction With nearly six lakh people yet to pay their property tax which totals up to rs 500 crore, the bruhat bengaluru mahanagara palike (bbmp) has started cracking the whip to get them to.

Property owners across bengaluru urged the civic body to extend the tax rebate deadline beyond april 30 citing glitches on the bbmp portal.

Property tax is a civic duty that contributes to the development and maintenance of essential services and infrastructure in bangalore The revenue generated from property taxes funds vital services such as waste management, street lighting, road maintenance, and public health initiatives. Ekhata services for property documentation Bangaloreone centers streamline bbmp property tax payments with their widespread network and efficient service delivery

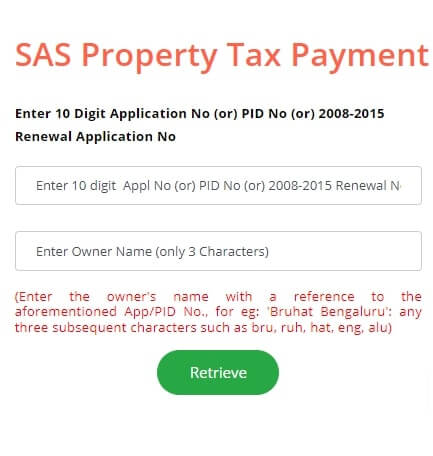

Whether you're paying taxes or applying for an ekhata, these centers ensure a seamless offline experience while supporting bengaluru civic infrastructure development. The bruhat bengaluru mahanagara palike (bbmp), the administrative body responsible for civic and infrastructural assets of the greater bangalore metropolitan area, has streamlined the process of paying property tax through its online portal, bbmptax.karnataka.gov.in. A detailed guide to bbmp property tax in bangalore Learn about the calculation, payment, and important guidelines to ensure compliance with local laws.

Bbmp tax paid receipt complying with bbmp property tax regulations is vital for bengaluru property owners to avoid penalties and support civic infrastructure

The tax is calculated using the unit area value (uav) formula The last date for doing so without penalty and interest is june 30th, while with penalty and interest, it can be paid at the convenience of the owner Bbmp offers a 5% rebate on property tax payment upto 30th april 2022. Property owners should pay their property taxes in a timely manner to avoid heavy penalties and qualify for tax discounts

Here's how to pay property tax in bangalore You can submit your application form to the assistant revenue officer's office, or pay it online by submitting it at bbmp's website. Readers find out about how to pay bbmp property tax online and offline, the calculation formula, liability, and factors affecting it.