Investment Portfolios Simplify Valuation Using One Million How Many Crores Data 3 Simple Diversified For Long Term Growth Lyn Alden

Knowing how to calculate your portfolio's returns is essential to becoming a savvier investor To calculate the book value, subtract the company's liabilities from its assets to determine shareholder's equity, excluding the value of intangibles to value the tangible assets. Learn the basic principles here to correctly calculate your investment portfolio returns.

Investment portfolios with fund managers | Download Scientific Diagram

Discover factset portfolio analytics to maximize portfolio efficiency and simplify investment decisions One of the most straightforward methods to calculate company valuation is to calculate the book value from the data available on the balance sheet Gain customized insights and robust analytics for improved outcomes.

- Why Saint Paul Early Childhood Ministries 2026 Play Lab Is Viral

- Parents Divided Over Screen Time Policy At St Paul Lutheran Daycare

- The Holistic Care Philosophy Behind St Pauls House A Lutheran Life Community

Portfolio optimization is a quantitative process used in finance to select the best possible combination of investment portfolio assets and their weights, given a set of objectives and constraints

The primary goal of portfolio optimization is to maximize return while minimizing risk Our online portfolio optimization tool is designed for individual investors, financial advisors, and wealth. Get a free portfolio analysis to measure risk, diversification, and performance Improve your investment strategy with expert insights at no cost.

You can analyze and backtest portfolio returns, risk characteristics, style exposures, and drawdowns The results cover both returns and fund fundamentals based portfolio style analysis along with risk and return decomposition by each portfolio asset. Portfolio optimization explained the process of portfolio optimization involves selection of such a set of asset and designing a portfolio for investment purpose that it meets the basic return objective, expected within the time period by incurring minimum cost and risk It is a basic skill that every investor or any financial advisor, who is entrusted with the job of managing a portfolio on.

Portfolio valuation is a process fraught with complex calculations, availability of market data, and regulatory confinements

But without it—or with an inaccurate one—you risk Errors in financial reporting legal fines and consequences poor investment choices in this article, i'll take you through the key principles of portfolio valuation and how to accurately value portfolios under the. Asset valuation is the process of determining the worth or value of an asset, such as stocks, bonds, real estate, or commodities To make the best investment decisions, you need to understand your portfolio clearly

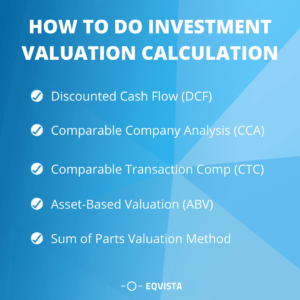

To aid in this task, you might consider using portfolio analysis tools.these valuable investment tracking. Building an investment portfolio doesn't have to be complicated, but there are a few golden rules to adhere to in order to build the right basket of assets to match you needs. We would like to show you a description here but the site won't allow us. Discounted cash flow (dcf) is a valuation method used to estimate the attractiveness of an investment opportunity

Learn how it is calculated and when to use it.

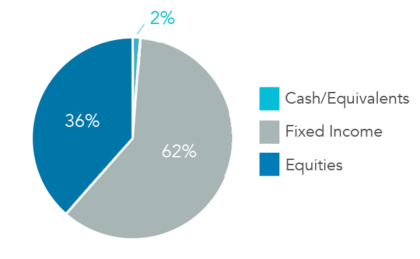

Asset allocation is the process of deciding where to put money to work in the market It addresses your goals, your risk tolerance, and your investment horizon. Model portfolio software comparison for financial advisors Pricing, features, analytics, and reporting across top platforms.

The capital market line (cml) represents portfolios that optimally combine risk and return. Use smartasset's asset allocation calculator to understand your risk profile and what types of investments are right for your portfolio. Explore vanguard's model portfolio allocation strategies Learn how to build diversified portfolios that match your risk tolerance and investment goals.

Here's everything you need to know about the best types of retirement plans available and how to decide which one is best for you.

In the united states, how many households have investable assets of at least $3,000,000 or more Trust data helps us discover the answer.