New Bbmp Tax Incentives Promote Sustainable Green Roofing Across The City Truth About Are Y Effective?

The grta is a government initiative that offers financial incentives to nyc building owners who install green roofs The most comprehensive source of information on incentives and policies that support renewables and energy efficiency in the united states The new and improved 2024 green roof tax abatement encourages building owners to install green roofs by offering a break on their property taxes.

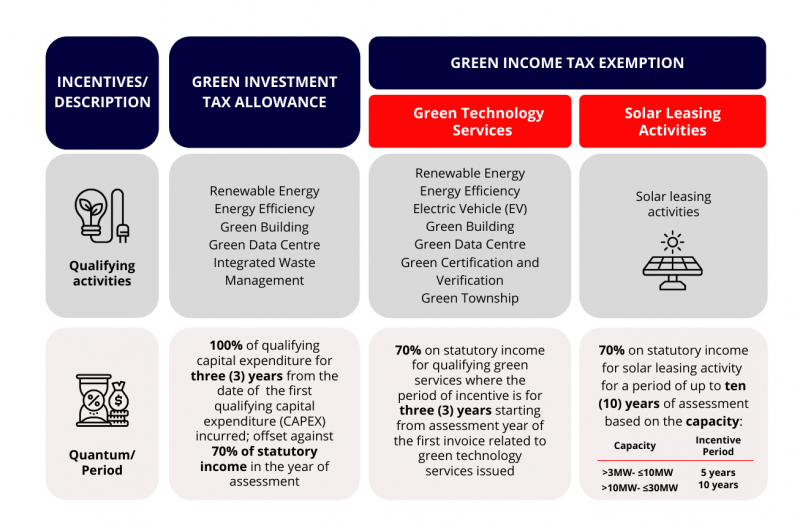

Green Technology Incentives: Towards Achieving Sustainable Development

Green roofs are becoming a popular amenity for modern buildings due to their numerous environmental benefits Dodds and butler (2010) illustrate the need to study the implementation of tourism policies in terms of achieving sustainable tourism They help reduce the urban heat island effect, manage stormwater runoff, improve air quality, increase biodiversity, and extend roof lifespans

- Inside The Sustainable Land Management Techniques Of Branch Kampe

- Year Round Learning Modules Reshape The Glen Burnie High School Calendar

- New Study Reveals Unseen Link St Paul Allergy Spike Tied To Urban Green Spaces

Cities are even starting to incentivize their use, and new technologies are making them easier to install and maintain

Policy resources the green roofs for healthy cities 2023 policy guide is designed to provide professionals in the green infrastructure industry with information about where to source supportive policies and programs for green roof and wall installation across north america It is also designed as a resource for policy makers and advocates that are interested in establishing or updating green. Installing a new roof can be a significant investment, but various government programs offer rebates and incentives to help offset the cost Here's an updated guide to government rebates for roofing in 2025.

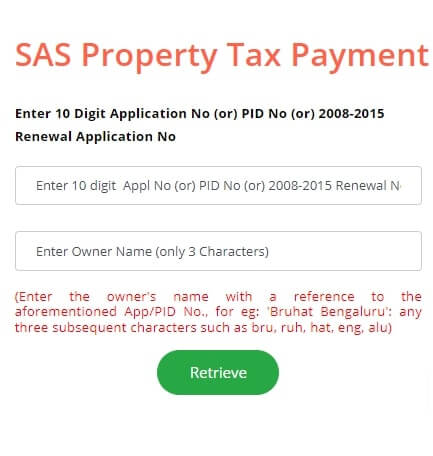

Before installing a green roof, consider the initial construction investment, maintenance cost, return on investment, and financing options, including grants and tax incentives provided by nyc and other entities. This is for building a green roof on homes and businesses in new york city Another tool municipalities may use to encourage green roofing is through the issuance of grants, tax credits or fee waivers for the construction of green roofs Interested in learning more about green roof legislation in new york city

We break down new regulations as well as existing tax credits and grant programs.

What are green roof tax credits Green roof tax credits are financial incentives provided by governments to encourage the installation of vegetative roofing systems These credits aim to offset the initial costs of green roof construction, making them more accessible to property owners and developers By reducing taxable income or offering direct rebates, these programs promote sustainable.

Discover 5 strategies to maximize green roof tax incentives and save up to 80% on installation costs while boosting sustainability and reducing your property's environmental impact. A more sustainable agriculture is needed to address global food security and environmental degradation This scoping review surveys the incentives for farmers to adopt sustainable practices. With the global population set to continue growing, the demand for energy will increase

Fossil fuel resources are in decline, and their use is associ…

Learn more about solar roof. It isn't given as payment for services you provide Many states label energy efficiency incentives as rebates even though they don't qualify under that definition. Management of sustainable transportation currently is one of the most important aspects of a country's or a region's development from an economic and …

Explore green building standards and certification systems to enhance sustainability, energy efficiency, and environmental responsibility in construction projects. The strategies for improving green building incentives were also found, the most important of these being the need for the government to redirect its approach of providing incentives so that owners can be encouraged to pursue green building The review findings signify the importance of the government in relation to green building incentives. Innovation has become the driving force behind china's economy's sustainable growth

Due to the efficient transmission of taxation leverage, preferential tax policies are frequently used to stimulate innovation

Therefore, the incentive effect of preferential tax policies on sustainable innovation has gradually become the focus of attention We would like to show you a description here but the site won't allow us. The adoption of electric vehicles (evs) is influenced by a range of incentives and barriers Evs offer benefits such as reduced emissions and lower costs but face challenges in gaining widespread acceptance

Government subsidies, tax credits, and ev charging infrastructure have played a pivotal role in driving ev adoption, making them more financially attractive and convenient Tax incentives are defined as tax rules that go against the generally accepted principles of tax neutrality and fairness which are aimed at fostering both foreign and local investment since they.