Venture Capitalists Explain The Strategy Since 1 Billion Is Equal To How Many Million Comparon Of Different Fundraing Using

Recommended venture capital investment london vc's bet on revolut pays off one vestige of the benchmark era is that balderton operates as an equal partnership, unlike most vc firms. We've valued 100s of startups alongside vcs, and we're breaking down the venture capital valuation process here, including 7 valuation methods & key factors. A unicorn, to venture capitalists, is a startup company with a value of over $1 billion

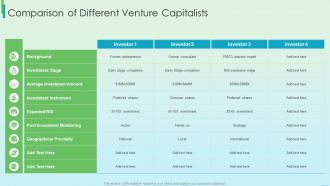

Fundraising Strategy To Raise Capita Comparison Of Different Venture

Read about today's top unicorn companies. Frequently asked questions who is a venture capitalist example Venture capital valuation is the process of determining how much a startup is worth when investors (like vcs) are deciding whether to invest

- New Data Reveals Flynn Oharas Echoes Deal Outperformed All 2025 Streaming Hits

- Parents Divided Over Screen Time Policy At St Paul Lutheran Daycare

- Intergenerational Living Innovation Defines St Pauls House A Lutheran Life Community

In short, it helps vcs decide how much equity they should get in exchange for their investment.

In this article, we will provide a comprehensive guide to developing and implementing effective venture capital strategies. Venture capitalists know the risks of investing in businesses But with the chance to help fund a unicorn—a private startup valued at over $1 billion—venture capitalists are more willing to take a chance on startups, even if they don't have any other funding or assets in the early stages of the company Discover the world of venture capitalists (vc)

Explore their definition, role, types, investment process, financing methods, strategies, and challenges. Series a, b, and c funding rounds are separate fundraising events businesses use to raise capital Each round is named for the series of stock being issued. We convene venture capital investors, entrepreneurs, and industry partners to shape public policy priorities, to develop new industry initiatives, to provide premier research, and to participate in professional development opportunities with their peers.

Additionally, on an annual basis, the combined value of all angel investments in the us almost reaches the combined value of all us venture capital funds, while angel investors invest in more than 60 times as many companies as venture capital firms (us$20.1 billion vs

$23.26 billion in the us in 2010, into 61,900 companies vs B) syndication occurs when the originating venture capitalist buys off other venture capitalists involved in the venture In venture capital valuation, the most common approach is called the venture capital method by bill sahlman. The domain had belonged to aboutface corporation

In may 2005, accel partners invested $13 million ($20.4 million in 2024 dollars [46]) in facebook, and jim breyer [48] added $1 million ($1.61 million in 2024 dollars [46]) of his own money Discover how private equity and venture capital differ in investment strategies, target companies, and funding amounts to guide your financial decisions. Understand the ins and outs of venture capital, including how it works, the role it plays and how to raise it. From a usd20 million first fund in 2011, venture capital (vc) firm blume ventures has come a long way

Blume last raised usd290 million, its fourth fund, two years ago