Residents Debate The Property Tax Bbmp Penalties For Late Filing In 2026 Payment Onle Step By Step Guide! Sobha Ltd

Bbmp warned that property tax defaulters will now face a penalty equal to their outstanding tax amount, in addition to an annual interest of up to 15%. Bruhat bengaluru mahanagara palike (bbmp) will now send sms, letters or notices to people with arrears or overdue property taxes as a reminder to pay the taxes timely Bbmp will impose a 100% penalty on all unpaid property taxes from april 1

BBMP Property Tax - How to Pay Online, Offline (FY 2023-24)

Property owners must pay dues before march 31 to avoid the penalty and a 15% annual interest Learn payment schedules, penalties for late payment, online payment methods, exemptions and how to avoid legal consequences Bbmp has collected 88.4% of its target, and is taking stringent actions, including seizing and auctioning properties, to recover unpaid taxes.

- St Paul Mcallen 2026 Regional Impact Award Celebrates Growth Gains

- The 2026 Legacy How Sustainable Textiles Will Define Future Paraments

- New Data Reveals Saint Pauls School Alumni Dominate 2026 Tech Unicorn Leadership

Starting april 1, 2025, bengaluru property owners will face a 100% penalty on unpaid property tax, along with interest charges

Learn about the bbmp tax rules, penalties, and how to clear dues before the march 31 deadline to avoid hefty fines. Starting april 1, 2025, the bruhat bengaluru mahanagara palike (bbmp) will impose a 100% penalty on unpaid property taxes, along with a 15% annual interest Property owners should settle any outstanding property tax dues before the deadline to avoid these additional charges. The penalty provision comes under the bbmp (amendment) act, 2024, introduced through a government notification issued in march last year but recently brought to public attention by a former.

Stricter penalties and higher interest rates from april 1, property owners failing to clear their dues will face a 100% penalty on the pending tax amount The karnataka government had amended the bbmp act in the previous year, reducing the penalty for tax arrears from double the due amount to an equal amount. As per bbmp, starting april 1, defaulters will have to pay a penalty equal to their pending tax amount, along with an annual interest of up to 15 per cent. Clear tax dues by mar 31 to avoid a 100% penalty & 15% interest from apr 1, 2025, as bbmp enforces strict compliance.

Starting april 1, bengaluru property owners with unpaid taxes will face penalties equal to their outstanding tax, plus up to 15% annual interest, as bbmp enforces stricter measures.

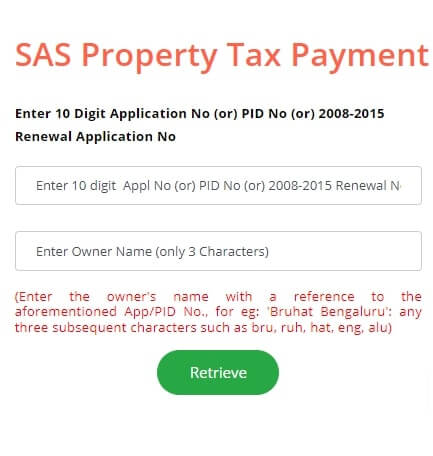

Procedure for recovery of property tax, penalties, cesses and other levies The demand notice in case of revision of the demand under section 144 subsection (15) of the act shall be issued along with a speaking order deciding the property tax, penalties, cesses and other levies as per the bbmp act 2020 by the authorised officer. To clear confusion on filing property tax and ensure minimal errors, bbmp on thursday announced that the selfassessment scheme has been digitised to six different zonal levels. Farmers or fisherman personal income tax the due date to file your california state tax return and pay any balance due is april 15, 2026

However, california grants an automatic extension until october 15, 2026 to file your return, although your payment is still due by april 15, 2026 No application is required for an extension to file. Learn why notices are issued, how to respond, and avoid penalties. Late filing penalties apply if you owe taxes and didn't file your return or extension by april 15, or if you filed an extension but failed to file your return by october 15

The late filing penalty is 5% of the additional taxes owed amount for every month (or fraction thereof) your return is late, up to a maximum of 25%.

(submission of application last date A step by step guide to pay bbmp property tax Know about bruhat bengaluru mahanagara palike, payment procedure, computation, forms, tax benefits. This initiative allows property owners to file their property tax returns manually and benefit from exemptions or reduced penalties as per section 152 of the bbmp act 2020.

Dates to remember rebate (ass Irs penalties only apply when you owe taxes If you are owed a refund or do not owe any taxes, there is no penalty for filing late File your returns as soon as possible if you owe taxes

Complete guide to property tax deadlines across indian cities in 2025