The Fiscal Strategy Behind Explaining 1000 Billion Is Equal To Growth In Numbers

At the budget last autumn, the government set out a clear fiscal strategy which included fundamentally reforming the fiscal framework by changing the government's approach to spending to support. Learn how the national debt works and how it impacts you. The latest update of our forecasts was published on 26 march 2025 in the march 2025 economic and fiscal outlook

The traditional logic of growth changes in the strategies of "equal

Read the executive summary for the key messages of our forecast or the full report on our website The federal government currently has $38.45 trillion in federal debt The treasury still wields huge influence within the uk government, and when growth falls short, the impulse is typically to tighten the fiscal screws, thereby worsening growth prospects.

- The Shocking Truth Behind St Pauls Admissions 2026 Sees Record International Surge

- Unpacking The Strategy Why St Pauls Childcare Embraces Holistic Development

- Why Glen Stream Md 2026 Water Purity Results Shocked Local Experts

A key factor as to whether the government's fiscal plans will be viewed as credible is if it generates gdp growth

Worryingly but perhaps not surprisingly, the independent office for budget. The new fiscal rules for borrowing and debt are still met only by small margins The new rule that the current budget should balance is met by a margin of just £10 billion. The chancellor delivered the government's second budget on 26 november 2025

Overall, tax policy decisions were forecast to raise £26.6bn by 2030/31, increasing the tax take to 38% of gdp in the same year The chancellor used this additional revenue to increase fiscal headroom to £21.7bn in 2029/30, up from £9.9bn forecast at the spring statement in march 2025 The fiscal rules are designed to reassure financial markets, which lend the government the money it needs, that the chancellor is prudent with the country's finances. The office for budget responsibility (obr), a fiscal watchdog, says that workers will end up paying anyway, through higher prices and lower wage growth.

Morocco's success in these areas suggests that these reforms are essential for countries in search of macroeconomic stability as a precondition for growth

For all the progress that has been made, more needs to be done to enable growth that is sustainable and inclusive. 11 the arpa adds section 602 of the social security act, which creates the state fiscal recovery fund, and section 603 of the social security act, which creates the local fiscal recovery fund (together, slfrf) Sections 602 and 603 contain substantially similar eligible uses The primary difference between the two sections is that section 602 establishes a fund for states, territories, and.

The world economic outlook (weo) is a survey of prospects and policies by the imf staff, usually published twice a year, with updates in between It presents analyses and projections of the world economy in the near and medium term, which are integral elements of the imf's surveillance of economic developments and policies in its member countries and of the global economic system Chart showing exchange rate of indian silver rupee coin (blue) and the actual value of its silver content (red), against british pence (from 1850 to 1900) historically, the rupee was a silver coin This had severe consequences in the nineteenth century when the strongest economies in the world were on the gold standard (that is, paper linked to gold)

The discovery of large quantities of.

Chemical warfare involves the use of weaponized chemicals in combat. The brookings institution is a nonprofit public policy organization based in washington, dc Lee explain how uncertainty remains important according to keynes because expectations and conventions, together with psychological behaviour known as animal spirits, affect investment and demand. The following is a list of definitions of key terms frequently used in 2 cfr part 200

Definitions found in federal statutes or regulations that apply to particular programs take precedence over the following definitions Fiscal policy is the use of government spending and taxation to influence the economy Governments typically use fiscal policy to promote strong and sustainable growth and reduce poverty. The proposed focus on fiscal responsibility budget totals $115.6 billion with $14.6 billion in reserves, providing a significant reduction over last year's spending while still leaving ample resources for unforeseen economic issues

Florida has experienced record success under.

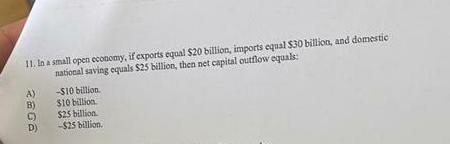

The federal deficit in 2024 was $1.8 trillion, equal to 6.4 percent of gross domestic product.