The Government Strategy For Taxing Farmland Based On Hectare Measurement What Is ? Geeksgeeks

Current use programs are an important tool in the farmland preservation toolbox and this guide intends to provide a working framework toward understanding the theory and practice of such programs to keep agricultural lands working. Improving land use efficiency is therefore key to reduce total emissions from. For example, farm real estate values in the corn belt are nearly twice the national average, while farmland real estate values in the mountain region are less than half the national average

Multi-spectral reconstruction of gridded farmland. The encoded

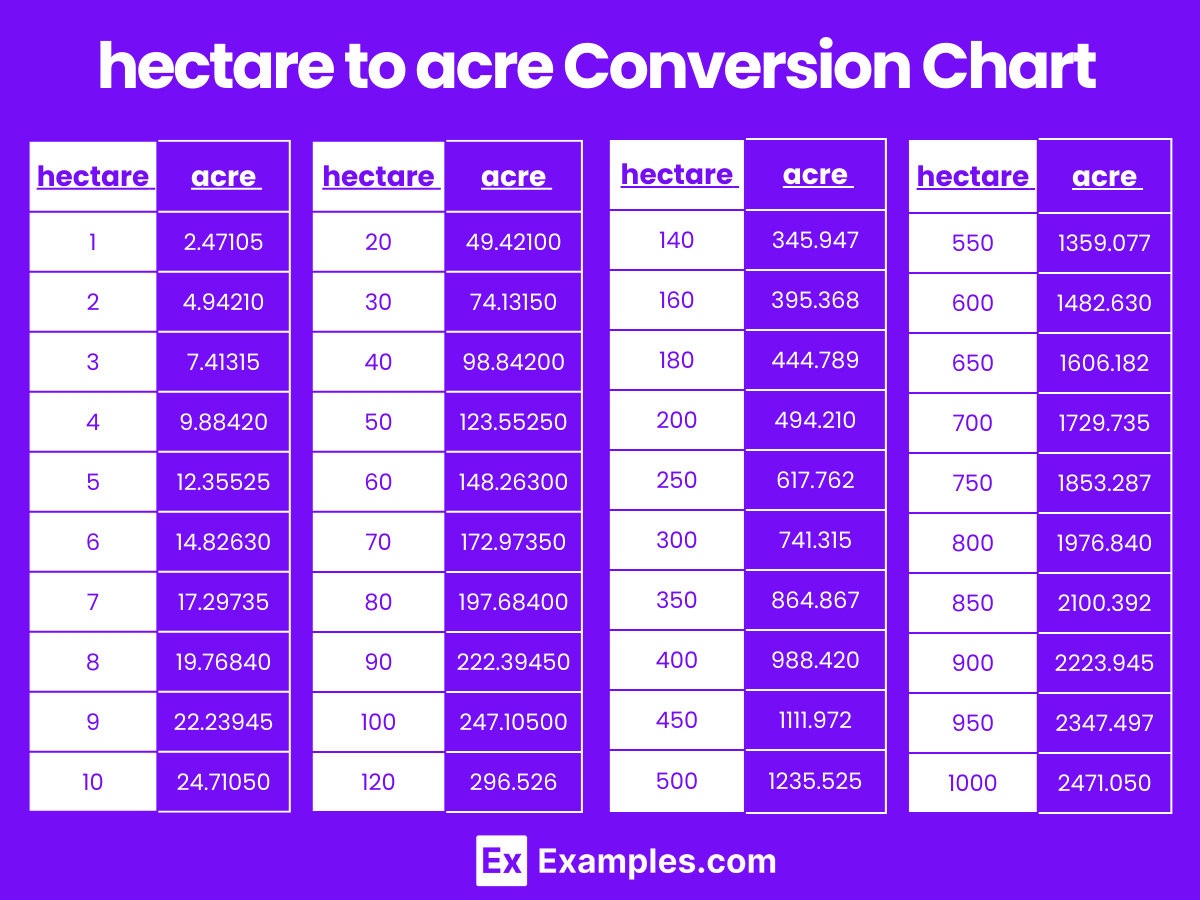

Download chart image in addition to regional differences in the value of land, the rate of growth varies by region. Transforming nature into agricultural land in order to grow more food Property tax savings for farmland differential assessment and current use programs help owners of farmland and other open spaces pay lower property taxes

- New Data Reveals Saint Pauls School Alumni Dominate 2026 Tech Unicorn Leadership

- The Grand Avenue Project Charting The Next Decade For St Paul

- Market Shock Unexpected Drop In Key Inflation Number Stuns Analysts

Property is generally taxed by various levels of government (municipal, county, and state)

Generally, the more valuable the property, the higher the property tax. By taxing farmland at its market value, farmland owners were paying for a larger portion of public programs supported by real estate taxes Maryland was the first state to adopt preferential tax programs for agricultural land in 1957 in response to the rapid urbanization from neighboring washington, d.c, with other states adopting similar. Changes in the tax on land and buildings are recommended as improvements in the preferential assessment of agricultural land

Tax revenue the real property tax reflects a public interest in land and its improvements.' cause agriculture occupies a vast amount of land, the tax on that land represents broad public interest in its value and use. 6 for example, tax analysts (2013) reports on an indiana tax court case related to the allisonville development company's challenge to hamilton county's reassessment of its land based on the land use change from agriculture to undeveloped, usable commercial land After the landowner succeeded in the assessment challenge, the county reassessed the land as agricultural rather than commercial. Using various examples, alternatives and illustrations around the world, the guide provides a compelling case for generating local revenue through land and its improvements.

This tax preference amounts to tens of billions of dollars annually.

Equitable distribution of the tax burden Assistance to family farmers in difficult financial straits And land use planning to avoid sprawl and protect open space Because those goals sometimes conflict.

Us income taxes guide once entities have identified their uncertain tax positions, they need to determine when, if ever, the tax return benefit (or expected tax return benefit) should be recognized for financial reporting purposes The following principles should be employed when assessing the recognition of benefits from an uncertain tax position. Staying informed about local ordinances, deadlines, and potential exemptions is crucial for accurate tax computation and compliance. This paper studies the effects of policy scale for land conservation schemes based on global objectives but implemented at local levels

They are explored in the classical reserve site selection framework for policy efficiency, to which we add the common social objective of equity between spatial units.

3.2 definition of variables 3.2.1 agricultural operating income in this paper, agricultural operating income refers to the income obtained by farmers by cultivating land It is mainly measured by the amount of income and rate of return, which are calculated by the net income per hectare and rate of return per hectare, respectively. 1.1 overview rics acts globally to promote and enforce the highest international standards in the valuation, management and development of land, real estate, construction and infrastructure This professional standard provides advice on the measurement of land areas for planning and development purposes.

Property tax, in that a land tax taxes the value of the land only, whereas a property tax taxes the value of the land and the fixed improvements made on it (e.g A house, a farm building, and irrigation canal) The main arguments in favor of land taxation are based on economic, land use, administrative and social justice considerations. The marketplace for soil carbon is still rapidly evolving and landowners need to consider which finance option best suits their specific circumstances

There will be a range of implications depending on the scheme, such as ongoing costs, contractual obligations, taxes, property values and agreements with supply chains

All of these may impinge on future land uses and reduce flexibility. Development of agricultural output of india in 2015 us$ share of labour force employed in agriculture in india the history of agriculture in india dates back to the neolithic period India ranks second worldwide in farm outputs Location both economic and socialized housing projects shall be located within suitable site for housing and outside potential hazard prone and protection.

Agriculture attempts to satisfy the demand for food of a growing human population but contributes to environmental degradation However, there are technological options for agriculture to deliver. Theagriculture, forestry and other land use 1 (afolu) sector encompasses managed ecosystems and offers significant mitigation opportunities while delivering food, wood and other renewable resources as well as biodiversity conservation, provided the sector adapts to climate change Acknowledging disagreement has existed on both technological and.

Agriculture is a major source of greenhouse gas emissions, accounting for around 1/5 of total global greenhouse gas emissions

The largest contributor within agriculture is land use change