The Revenue Strategy Behind The 2026 Mcd Property Tax Assessment Revisions & Ndmc Propose Reforms To Simplify Delhi

Get the latest on property assessment for real estate Apply for dog license malin basti & abadi property tax form pay online tax city map help desk Learn about deductions and tax strategies critical for investors in 2026.

MCD Property Tax Payment 2025 – How to Pay Online @mcdonline.nic.in

Maryland property tax credit program deadline maryland also has a homeowners' property tax credit program which limits the amount of property taxes you must pay based on income. Other changes to medicare part b payment policies to ensure that payment systems are updated to reflect changes in medical practice, relative value of services, and changes in the statute Property tax assessment notices for properties in group 2 were mailed today

- St Paul Mcallen 2026 Regional Impact Award Celebrates Growth Gains

- Year Round Learning Modules Reshape The Glen Burnie High School Calendar

- How St Paul Baptist Church Baltimore 2026 Youth Hub Cut Crime Rates

Property tax rates remain unchanged for a second.

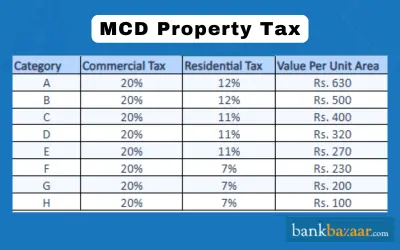

Rates specified below of the annual values of covered space of buildings and vacant lands or part thereof (based on the. Mcdonald's financial statements and annual reports are available for investors and general public viewing See featured mcdonald's financial news. The proposed property tax collection target is rs 4,000 crore, a substantial increase from rs 3,121 crore

As of now, the mcd has collected rs 1,692 crore under this head. North carolina's upcoming reassessment cycle marks a significant reset for property owners North carolina's 2026 property tax revaluations may significantly impact commercial assessments Learn which counties are affected and why early review matters.

*** assess your property tax on your own

New tax payers can search their property from old legacy data using search property option that appears after login to your account Old users after login click on action button to pay tax directly. The fields marked * are mandatory Enter the customer number and address of the property you wish to login.

Ach credit is an electronic payment method that you may use to pay tax liabilities Using this payment method requires you to directly instruct your financial institution to transfer funds from your bank account to the department's bank account. The maryland department of assessments and taxation (sdat) makes tax credits available to qualified individuals For information about the homeowners', homestead and other tax credits visit

Maryland property tax credit programs

For information on the 100% disabled veteran exemption, blind exemption and others visit Providers can also view letters sent to them from texas health and human services regarding the appeals Questions about the status of submitted administrative appeals can be emailed to mcd_administrative_appeals@hhsc.state.tx.us. The conceptual framework may be revised from time to time on the basis of the board's experience of working with it

Revisions of the conceptual framework will not automatically lead to changes to the standards Any decision to amend a standard would require the board to go through its due process for adding a project to its agenda and developing an amendment to that standard. Encumbrance certificate for last 33 years electricity connection caution deposit receipt recent electricity bill vacant land tax payment challan Submit objection to the proposed assessment to your own property

Submit objection to the proposed assessment for someone else's property

Receive online confirmation and a transaction reference number For net banking transaction charges will be rs (1) administer tax law for 36 taxes and fees, processing nearly $37.5 billion and more than 10 million tax filings annually (2) enforce child support law on behalf of about 1,025,000 children with $1.26 billion collected in fy 06/07

(3) oversee property tax administration involving 10.9. This major proposed rule addresses Changes to the physician fee schedule (pfs)