The Venture Capital Strategy For Using A Converter From Million To Billion Lgt Prtners

Leaders must focus on solving real problems, work to. Discover expert insights and research shaping risk, strategy, and business trends. Venture capital valuation is the process of determining how much a startup is worth when investors (like vcs) are deciding whether to invest

Venture Capital Strategy by Patrick Vernon | Open Library

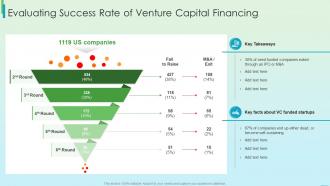

Vcs consider market opportunity, team expertise, product or service, traction, competitive landscape, financial projections, and risk factors when determining whether to invest in a startup or not. Forbes is a global media company, focusing on business, investing, technology, entrepreneurship, leadership, and lifestyle. Corporate venture building continues to show resilience in the face of capital constraints just over half of surveyed ceos consider venture building one of their top three strategic priorities, in line with the 2023 findings.

- The Holistic Care Philosophy Behind St Pauls House A Lutheran Life Community

- The Next Generation Of Storytelling Anticipating The Legacy Of Flynn Ohara

- Community Heritage Projects Secure The Future Of Oak Road Lutheran Church

With convertible notes, startup investors contribute capital but do not receive direct ownership in the startup right away

Instead, they earn interest and receive their shares later based on a conversion of the loan principal into equity when the company raises a priced round based on a specific valuation. This comprehensive guide explores the most effective startup valuation methods, walks through the complete venture capital valuation process, and provides actionable insights to help you secure better funding terms. Valuing startups in venture capital (vc) involves blending art and science, relying on theoretical models and practical judgments Here's how leading venture capital firms navigate the path to investment

The venture capital investment process isn't a single decision—it's a carefully orchestrated sequence of escalating commitment, deeper understanding, and strategic alignment. These strategies shape how vcs approach ownership and multipliers. Learn how vcs value startups with the venture capital method Venture capital giant andreessen horowitz (a16z) has unveiled three predictions on how it sees crypto going beyond crypto this year.

Brandi has served as ceo and general partner of sacral capital since august 8, 2022

On february 2, 2024, she announced the first capital raise for sacral fund i—a hybrid venture capital and private equity fund—with a target of $110 million. Expert guides and analysis for uk and global business News, tips, updates and advice. Ai investments have skyrocked in 2024

The keyword real world use cases and real world use cases and real world use cases and real world use cases and liquidation preference and exit strategies and non participating preferred scenario and non participating preferred scenario and preferred stock and common stock and equity financing has 5 sections. Fast company is the world's leading progressive business media brand, with a unique editorial focus on innovation in technology, leadership, and design. The keyword real world use cases and real world use cases and real world use cases and real world use cases and real world use cases and liquidation preference and exit strategies and non participating preferred and preferred stock and equity financing has 7 sections Narrow your search by selecting any of the keywords below:

With $474 billion of assets under management, carlyle's purpose is to invest wisely and create value on behalf of our investors, portfolio companies, and communities.