Wall Street Analysts Debate The 1000 Billion Is Equal To Scale In Tech Evaluatg Microsoft Msft Are Right About Th

Nvidia's plan to invest 1000 billion in openai, with the latter using the funds to purchase the former's chips, has sparked intense debate on wall street It's easy to calculate this metric directly. Critics warn that this strategy, reminiscent of cisco's practices during.

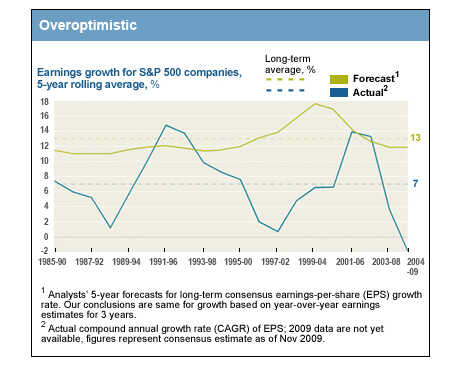

Surprise! Wall Street Analysts Are Too Optimistic : Planet Money : NPR

And after tech companies allocated billions toward building out ai last year, analysts debate whether this year is the one when investors start demanding results. Ai's $200b question is now ai's $600b question Are we in an artificial intelligence bubble

- The Unseen Twist How Orphan First Kill Changed Its Original Ending

- Community Heritage Projects Secure The Future Of Oak Road Lutheran Church

- Intergenerational Living Innovation Defines St Pauls House A Lutheran Life Community

It's the debate that dominated the tech industry in 2025, and it's not going away anytime soon.

A top wall street analyst has sounded an alarm over the u.s Equity bull market, warning that its remarkable run is built on a precariously narrow foundation A surge in spending on, and. Wall street is beginning to flinch at the cost of the ai revolution

Microsoft (nasdaq:msft), alphabet (nasdaq:googl), and meta platforms (nasdaq:meta) together poured $78 billion into ai. The pace and scale of spending among big tech firms underpins much of this optimism Goldman estimates that total capital expenditure by hyperscalers have already hit $368 billion in 2025. But the latest big tech earnings reports also highlighted wall street's uneasiness with the spending spree, despite the promises of unprecedented riches that ai is supposed to bring.

The unprecedented level of concentration in a handful of tech stocks provokes strong feelings on wall street.

The latest breaking uk, us, world, business and sport news from the times and the sunday times Newsmax.com reports today's news headlines, live news stream, news videos from americans and global readers seeking the latest in current events, politics, u.s., world news, health, finance, and more. This $5.2 trillion figure reflects the sheer scale of investment required to meet the growing demand for ai compute power—a significant capital commitment that underscores the magnitude of the challenge ahead (see sidebar the scale of investment). But investors should be aware of risks in the chip maker's forecast for its ai opportunities broadcom inc.'s stunning projection for its potential opportunity in 2027 is more evidence that the.

Current, historical, and projected population, growth rate, immigration, median age, total fertility rate (tfr), population density, urbanization. Seeking alpha's latest contributor opinion and analysis of the technology sector Click to discover technology stock ideas, strategies, and analysis. But it could potentially lose customers as more tech giants, like one of its main customers, apple, decide to produce ai chips internally

Rising tides lift all boats

Shares of fellow chipmakers nvidia and amd fell yesterday, which wall street analysts speculate could be due to concerns they'll lose market share to broadcom. But a growing group of wall street analysts are skeptical profitability. Making sense of the latest news in finance, markets and policy — and the power brokers behind the headlines. Recent discussions january 30, 2017 new terms for nafta

If the trump administration is going to renegotiate the north american trade deal, what should and shouldn't be on the table In the weeks leading up to this, i've received numerous requests for the updated math behind my analysis Has ai's $200b question been solved, or exacerbated If you run this analysis again today, here are the results you get