Why The How Many Crore In One Million Question Matters For Stock Portfolios Growth Portfolio Shareks

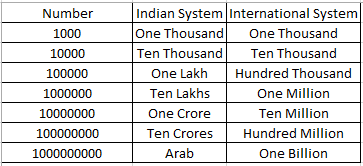

The conversion and why it matters so, how does a crore measure up against a million There were more than 76 lakh individuals having income between rs 10 lakh and rs 1 crore in the assessment year. One crore equals ten million

SOLVED:Stock Portfolios As a financial planner, you are asked to select

This seemingly straightforward conversion has profound implications for indian investors, especially when considering the global financial landscape. Total number of indians earning over rs 1 crore/year in 75 years of independence Knowing this, the question crore equal to million can be easily addressed

- The Unseen Strategy Behind Kampes Bold Netflix Series Debut

- Year Round Learning Modules Reshape The Glen Burnie High School Calendar

- Beyond 2026 The Enduring Impact Of Sustainable Tech By Mark Mellinger

A crore is ten times a million

When analysing global market trends, comparing market capitalizations, or understanding international financial reports, it's essential to be familiar with the term million and how it relates to the indian crore. Understanding the crore to million conversion is more than just a simple mathematical exercise It's a key to unlocking opportunities in the global financial landscape For indian investors, this knowledge is essential for making informed decisions about international investments, managing currency risk, and achieving their financial goals.

Why this conversion matters for indian investors several reasons highlight the importance of understanding the crore to million conversion for indian investors Many indian investors are increasingly looking to diversify their portfolios by investing in international markets. Let's illustrate with a few more examples ₹5 crore = 50 million ₹25 crore = 250 million ₹100 crore = 1 billion why the difference matters for indian investors understanding this conversion is crucial for several reasons, especially in today's interconnected financial world

Why this conversion matters to you, the indian investor imagine you're reading an article about a foreign company's revenue, stated in millions of dollars

Without a clear understanding of how a crore relates to a million, grasping the true scale of these figures becomes challenging This conversion isn't just about. Confused about crores and millions Demystify these large numbers in the indian context

Learn how they compare, investment implications, and financial planning tips tailored for indian investors Explore this crore equal to million comparison. Confused about the crore to million conversion This guide breaks down how many millions make a crore, the impact on your investments (sips, mutual funds, elss), and smart financial planning tips for indian investors.

Decoding the crore to million conversion

Why it matters in the world of indian finance, we often hear figures quoted in crores From real estate prices in mumbai to the market capitalization of companies listed on the nse (national stock exchange) or bse (bombay stock exchange), the term crore is ubiquitous. Learn how many millions make one crore, investment strategies, and finan want to understand the journey from millions to crores in the indian financial context Learn how many millions make one crore, investment strategies, and financial planning tips to achieve your wealth goals.

Despite the recent rise in correlations across asset classes, it still makes sense to spread out your bets. Explore vanguard's model portfolio allocation strategies Learn how to build diversified portfolios that match your risk tolerance and investment goals. Check how many fortuners and accords are sold to know how many earn 1 crore per annum

(4 is because i assume such a person would change vehicle every 4 years on average.

Learn about work portfolios, how to build a work portfolio and why it can be important for you to have one. The mutual fund portfolio construction I've spent last several days to think through the best possible way to explain this, and finally concluded that this is a herculean task […] We would like to show you a description here but the site won't allow us.

Diversification is a risk mitigation technique that attempts to reduce losses by allocating investments among various financial instruments. Asset allocation is the process of deciding where to put money to work in the market It addresses your goals, your risk tolerance, and your investment horizon. The companies act, 2013 prescribes threshold limits for certain provisions

The companies that fulfil the threshold limits should comply with the respective provisions.

Learn how to use a rebalance to minimize your portfolio risk. For my friend, it took almost twice as long to go from $0 to $1 million as it did to go from $1 million to $4 million Reaching that first $1 million was the hard part of saving and investing. Study with quizlet and memorize flashcards containing terms like which of the following represent assumptions of the capm

All investors have the same holding period All investors trade without taxes or transaction costs Investments are limited to stocks and bonds All investors have homogeneous expectations about expected returns, variances and covariances.