Why You Should Pay Property Tax Bbmp Online Before The April Deadline Ends Ment Step By Step Guide! Sobha Ltd

Bbmp property tax payment must be done every year Bbmp is not responsible for any double / excess payments The tax period commences in april and ends in march of the following year

BBMP Property Tax Payment Online- Step by Step Guide! - SOBHA Ltd.

Additionally, it includes links to resources for calculating your tax and understanding the payment process. Learn how to pay bbmp property tax online in 2025 Property owners must pay the bbmp house tax annually without any delay to avoid penalties

- St Pauls Manor 2026 Senior Tech Integration Wins National Awards

- Viral Op Eds In Sgb Weekly Spark Local Government Policy Debates

- Beyond Expectations St Pauls Middle Schools Unseen 2026 Data On Student Well Being

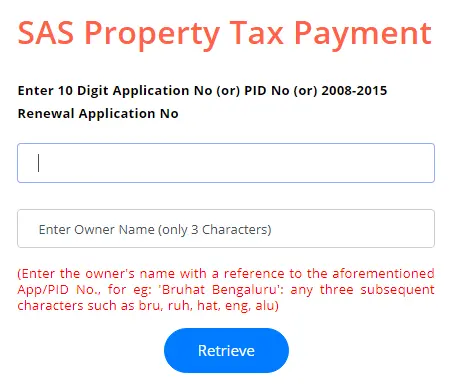

Property owners can pay the taxes online through the official website or at any bangalore one centers or bbmp offices

All property owners who pay their taxes in full before the due date, april 30, 2025, will get a 5% rebate. A step by step guide to pay bbmp property tax Know about bruhat bengaluru mahanagara palike, payment procedure, computation, forms, tax benefits. Avni arya updated mar 18, 2025, 09:07 ist bbmp has intensified property tax collection efforts, warning defaulters of a 100 pc penalty and up to 15 pc annual interest on pending dues from april 1

Property owners must clear payments before march 31 to avoid heavy fines. The tax period begins in april and ends in march of the following year Pay your property tax on time to avoid late fees and penalties. Starting april 1, 2025, bengaluru property owners will face a 100% penalty on unpaid property tax, along with interest charges

Learn about the bbmp tax rules, penalties, and how to clear dues before the march 31 deadline to avoid hefty fines.

In this blog, we will cover every aspect of bbmp property tax, including how to pay bbmp property tax, bbmp property tax rates, rebates, penalties, exemptions, payment modes, important documents, and the online process This will serve as a comprehensive guide for both new and experienced property owners in bengaluru. Refunds are processed within 15 working days Requirements for bbmp property tax payment keep these ready

Pid or sas application number previous year's tax receipt khata certificate (if applicable) rebates and due dates for bangalore property tax rebates Pay before april 30 to get a 5% rebate on total dues Learn about how to pay bbmp property tax online Get a detailed step by step guide for bbmp online tax payment

Also know about the bbmp tax forms, pid, payment status.

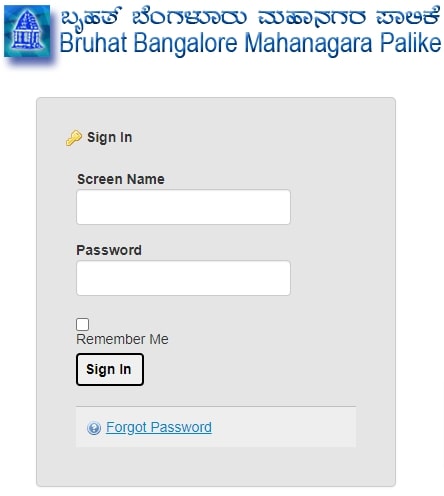

For online payment mode, request to pay the taxes well in advance to avoid payment failures due to technical issues at the last hour Bbmp is not responsible for any double / excess payments. Pay bbmp property tax 2025 online at the official website bbmptax.karnataka.gov.in/ Follow the given steps to pay bbmp property tax online in bangalore.

Pay bangalore bbmp property tax online easily Know how to calculate, pay, and download your property tax receipt Learn more with smfg grihashakti. Learn all about bbmp property tax in bangalore

Find out how to pay your tax, check rates, and understand the rules

Get the info you need to manage your property tax easily. Calculate and pay your bbmp property tax online What is the due date for bbmp property tax payment The last date for payment of property tax is march 31st for the assessment year

The tax can be paid in two instalments However, payment of the entire amount before july 31st makes the owner eligible for a 5% rebate Are there any rebates or discounts available? Every year, the bruhat bengaluru mahanagara palike (bbmp) collects property tax during the months of april and may, and a 5% rebate is accorded to encourage timely tax payments

This year, however, bbmp has extended the 5% rebate period for property tax payments till july 31, 2024

If you're a property owner in bengaluru, it's time to file your bbmp property tax return to avoid penalties and enjoy rebates