Wealth Managers Debate The Impact Of Million And Crore Usage In Global M&a This Week On

After a choppy start, markets found their stride, pushing global assets under management (aum) to a record $147 trillion by the end of june 2025 Nobody knows politics like politico. Most managers rode the rising tide, but fewer did so with a similar surge in profitability

Moriting Wealth Managers - Crunchbase Company Profile & Funding

Margins stayed tight as costs kept climbing First, it shows why policymakers need to focus on the poor and the middle class. The registered investment advisor (ria) space continues to be the most active m&a wealth management segment

- Why Saint Paul Early Childhood Ministries 2026 Play Lab Is Viral

- Shocking Data Saint Pauls Schools Alumni Dominate Forbes 2026 Under 30 List

- Intergenerational Living Innovation Defines St Pauls House A Lutheran Life Community

In the devoe & company ria deal.

The decade after the global financial crisis saw solid growth in wealth managers' client assets and revenue streams The number of m&a deals in which investment management and wealth management firms were the targets surged in 2025 21 deal volume in the first half of 2025 jumped 46% over the same period in 2024, marking the most active first half in more than a decade 22 much like in 2023, a substantial portion of these transactions targeted wealth.

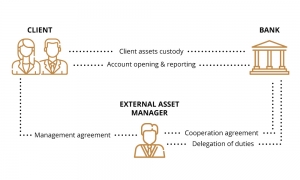

Despite a down year for m&a, wealth and asset managers selectively completed deals to help them consolidate, vertically integrate, broaden their offerings, and expand distribution The benefits of scale in technology and distribution will be especially important for wealth managers, and the benefits of scope will be important for asset managers considering expansion into alternative. Download the 2025 edition of the global wealth report Make sure you don't miss our key insights into global wealth trends.

These tools help wealth managers seeking to articulate the impact of global trends on their clients' investments, facilitating more informed decision making

Introduction the asset and wealth management (awm) industry faces a stark paradox Global assets under management (aum) are expected to rise from us$139 trillion today to $200 trillion by 2030, with as much as $230 billion of new revenue available to capture in the next five years By any conventional measure, this should be a period of prosperity for asset and wealth managers that have the. The m&a environment for financial advisory firms is entering a new phase of sophistication, selectivity, and strategic alignment

Let's dive into the dominant m&a trends shaping the wealth management. This whitepaper explores the impact of four key factors on wealth management firms We're on a journey to advance and democratize artificial intelligence through open source and open science. The free press journal thursday, december 18, 2025| vol

Wealth has been defined as a collection of things limited in supply, transferable, and useful in satisfying human desires

[13] scarcity is a fundamental factor for wealth When a desirable or valuable commodity (transferable good or skill) is abundantly available to everyone, the owner of the commodity will possess no potential for wealth. Discover how wealth management integrates financial services for affluent clients, including typical fees and services like estate planning, tax advice, and investment strategies. Discover how we help individuals, families, institutions and governments raise, manage and distribute the capital they need to achieve their goals.

The latest edition of the global wealth report is out now Make sure you don't miss our insights. The proliferation of artificial intelligence (ai) tools has transformed numerous aspects of daily life, yet its impact on critical thinking remains underexplored This study investigates the relationship between ai tool usage and critical thinking skills, focusing on cognitive offloading as a mediating factor

The asset and wealth management (awm) industry faces a stark paradox

Global assets under management (aum) are expected to rise from us$139 trillion today to $200 trillion by 2030, with as much as $230 billion of new revenue available to capture in the next five years. The biggest growth has been in lending and banking services Approximately 30 percent of clients with $1 million to $25 million in investable assets prefer to consolidate banking and wealth relationships, an increase of approximately 250 percent since 2018 More than 73 percent of.

The economic and social fallout from the global financial crisis and the resultant headwinds to global growth and employment have heightened the attention to rising income inequality